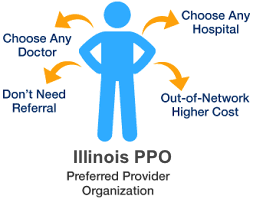

Shop Illinois PPO Health Insurance Plans in all 102 Counties

If you’re looking for health insurance plans and want to explore the options of an Illinois PPO plan, you’ve come to the right place. At Vista, we specialize in PPO health plans for individuals, freelancers, and small business owners. We can help you find the best plan for your needs and budget, whether you need comprehensive coverage, lower premiums, or more flexibility. Contact us today and let us show you why we’re the number one Illinois PPO health insurance market.

If you’re looking for health insurance plans and want to explore the options of an Illinois PPO plan, you’ve come to the right place. At Vista, we specialize in PPO health plans for individuals, freelancers, and small business owners. We can help you find the best plan for your needs and budget, whether you need comprehensive coverage, lower premiums, or more flexibility. Contact us today and let us show you why we’re the number one Illinois PPO health insurance market.

Illinois PPO Rates for 2024

Illinois PPO Rates for 2024

The table below contains common individual Illinois PPO plans, rates, and benefits included. This information is approximated so it’s suggested that you call for specific plan information.

| Plan Name | PCP Copay | Specialist Copay | Deductible | Rx: Generic/Brand/High Brand | Premium (single) |

|---|---|---|---|---|---|

| PPO Low Plan | $15 | $40 | $5,000 / $10,000 | $0 / NA / NA | $490.04 |

| PPO Flex Plan | $20 | $60 | $5,000 / $10,000 | $0 / 25% / 50% all after deductible | $862.00 |

| PPO High Plan | $40 | $60 | $2,500 / $6,750 | $0 / 25% / 50% | $1,047.00 |

| PPO Premium Plan | $25 | $35 | $350 / $700 | $0 / 25% / 50% | $1,287.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $15 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $0 / NA / NA |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% copay after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,000 / $14,000 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $40 |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $490.04 |

| Couple | $1,021.29 |

| E+child | $860.85 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% all after deductible |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | --------------------- |

| Single | $862.00 |

| Couple | $1,660.00 |

| E+child | $1,435.00 |

| Family | $2,080.00 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $40 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $2,500 / $6,750 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,750 / $13,500 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,047.00 |

| Couple | $2,214.00 |

| E+child | $1,799.00 |

| Family | $2,689.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 |

| Specialist Co-pay | $35 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $350 / $700 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $700 / $1,400 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 35% |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,287.00 |

| Couple | $2,639.00 |

| E+child | $2,222.00 |

| Family | $3,352.00 |

Illinois PPO Insurance Carriers

Below is the most recent list of Health Insurance carriers that offer Illinois PPO health insurance plans in 2024 for Small Businesses. Only certain insurance carriers make plans available to working individuals, Freelancers, and the self-employed. Please give us a call for more carrier information.

- Aetna

- Ambetter

- Assurant Health

- BlueCross BlueShield of Illinois

- Celtic

- Cigna

- Coventry Health Care

- Humana

- Golden Rule

- United Healthcare of Illinois

What to Know When Shopping for an Illinois PPO Insurance Plan

Listed below are some of the most common concerns when shopping for an Illinois PPO health insurance plan.

Are Your Doctors In-Network? –When choosing a health insurance plan, always check if your providers(s) are part of the PPO network. Although an IL PPO plan covers out-of-network services, you may pay more if you visit an out-of-network provider(s) than if you visit an in-network one.

Before you enroll in a costly PPO plan, you should not rely solely on the receptionist’s confirmation in your doctor’s office. Your best option would be to verify with the insurance carrier that your doctors are indeed in-network. Verification is important because if an out-of-network provider recommends a procedure, then all the services provided by that provider will be billed as out-of-network, even if the facilities and doctors are in-network. With an IL PPO health plan, your out-of-network medical treatment will count towards your out-of-network deductible and coinsurance.

Lower Monthly Premium May Result in Higher Costs – When it comes to health insurance, paying less for premiums usually means you pay more along the way as you use the insurance for medical services. A lower-cost health insurance plan may be suitable for you if you have no chronic conditions, no anticipated medical expenses, and no regular need for prescription drugs. This type of plan can help you save money on your premiums and avoid paying for coverage that you do not use.

On a similar note, a higher monthly premium may be a worthwhile investment for individuals who have frequent medical expenses and prescriptions. A careful assessment of one’s current and past health situation is essential when choosing an Illinois PPO health insurance plan that meets one’s needs and budget.

Health Insurance is a Contract – You and the IL PPO Insurance have entered into a binding agreement that is valid for a specified period (usually one year). During this period, you are expected to comply with the conditions of the agreement. If you are dissatisfied with the plan you chose, you cannot request a plan change from your insurance company at any time. You have to wait until the end of the agreement period to make any changes. Be certain to choose the right plan that works for you before signing the contract. If your State Marketplace plan has lapsed, you’re eligible to purchase an IL PPO health plan, mid-year as long as you are employed.

Insurance Coverage Types – HMO, EPO, POS, PPO, HSA, and HDHP. These are the most common types of insurance coverage available in the market today and have been for the past two decades. The main difference between these plan types is the level of flexibility they offer in terms of accessing specialists and receiving care outside of the network or the state. Moreover, different health plan types have different rules regarding the need for referrals. If you frequently visit specialists who are not part of your network, then you would benefit from a plan that allows you to do so.

For travelers who live and work in different states throughout the year, an Illinois PPO plan is a suitable option that provides flexibility. These plans let you choose any provider in or out of the network, with different levels of coverage. Another option is to enroll in an HSA or an HDHP plan, which are compatible with a health savings account (HSA). An HSA is a special bank account that lets you save money for medical expenses and enjoy tax benefits.

Are Essential Health Benefits Covered? – 10 essential health benefits should be covered by all ACA plans, including IL PPO plans. These 10 EHBs provide you with a guaranteed level of coverage set by the Affordable Care Act.

Why do we need 10 EHBs? A serious illness or injury can result in devastating financial consequences without adequate insurance coverage. That is why it is important to choose a health plan that meets the minimum essential health benefits (EHB) standard. This standard ensures that the plan covers a range of services that are essential for maintaining and improving health, such as preventive care, hospitalization, prescription drugs, mental health and more.

Most Common Questions Regarding an Illinois PPO Health Plan

Most Common Questions Regarding an Illinois PPO Health Plan

How much does an Illinois PPO cost?

PPO Plans are built to contain more flexibility when it comes to medical coverage. As a result, PPO Plans are more expensive than other plan types. Use the table above for the most up-to-date IL PPO rates.

Does my doctor accept Illinois PPO Insurance?

You can always phone your doctor’s office, though it is best to verify with the health insurance company directly. You can start by clicking your carrier’s link from the list above. Once you’re on their website, locate the provider directory list and see if they have a dedicated PPO network section.

Where can I buy an Illinois PPO health insurance plan?

Illinois PPO individual health plans are sold chiefly through broker representatives. They handle the plan selection and enrollment process for you, and they offer ongoing support for any insurance-related questions or problems you may encounter during the plan year. You’re best to work with a broker that’s appointed with multiple carriers in your area, this will provide you with a greater selection of plans and carriers to choose from.

Do I qualify for an IL PPO plan?

Being self-employed or a freelancer qualifies you to a get PPO plan. Some working individuals may also qualify however it’s up to the Business Association that is sponsoring the plan.

Can I buy an IL PPO plan anytime?

You can. IL PPO health plans have a 1/1 effective date every month of the year. Complete the application process by the 15th of the month for your coverage to begin on the 1st of the following month.

I’m not happy with my IL PPO health plan, what can I do?

Your only option is to find another PPO provider that will provide coverage, and then terminate your original plan. The terms of your health insurance contract are binding and you consented to them when you signed up. As a result, you are not allowed to change from plan A to plan B with the same provider before the end of your contract period. You would need to look for a different provider if you want to switch plans.

What makes an IL PPO plan special?

PPO plans value lies in its flexibility. You can select any doctor anywhere in the States. This is a tremendous advantage over any other plan type where you are required to use their in-network providers. This is most true for those who have serious medical conditions and need the freedom to choose.

Do I need to be part of a group or self-employed to buy an IL PPO plan?

The two most common ways of being insured under an IL PPO health plan are, as an employee of a company whose company plan is a PPO. The second would be for individuals, freelancers, and sole proprietors to join up with a business association that offers PPO plan options.

Can I buy IL PPO health plans from State Exchange or healthcare.gov?

Not for Individual health insurance coverage. The Federal Exchange and State Exchanges offer mostly HMO and EPO plan types. small businesses that purchase coverage through the exchange do have PPO options however they are limited.

Do freelancers qualify for IL PPO plans?

Individuals and freelancers are the same. But they must join an association that offers its members PPO health plan options.

Am I still qualified for an IL PPO plan if I am 65 or older?

Employed 65-year-olds have the option to keep their health insurance plan instead of selecting Medicare. If not employed, they could not be eligible for an Illinois PPO plan.

Are IL PPO plans offered as short-term medical plans?

Yes. Short-term medical is commonly purchased when between jobs or as a last resort plan type. Even though these short-term plans have strong PPO networks, 10 Essential health benefits are not all covered and are not comprehensive health plans. It is best to check the summary of benefits before purchasing.

Why are IL PPO plans more expensive than other types of health plans like HMOs?

Illinois PPO plans provide more flexibility and higher reimbursement rates for preferred doctors and hospitals, but they also have higher premiums than standard HMO plans, which require using in-network providers only. PPO plans offer the benefit of choosing a provider anywhere in the country.

Why do IL PPO plans have more hospitals and doctors in their network compared to non-PPO plans?

Insurance companies offer higher compensation rates to hospitals and doctors who join their PPO plans. This way, these medical providers, who usually reject the lower payment rates of other plans such as HMOs, are more likely to participate in a PPO.