Shop Affordable Nevada PPO Plans in all 17 Counties

If you are looking for a Nevada PPO plan that meets your needs and budget, or if you want to learn more about the Nevada PPO health insurance market and compare NV PPO rates, you have come to the right place. At Vista, we have the expertise and experience to help you find the best PPO plan for you. We have all the information you need to help you shop and compare Nevada PPO plans.

Nevada PPO Health Insurance Rates for 2025

Nevada PPO Health Insurance Rates for 2025

Below is a table of Individual Nevada PPO plan options. The information included, such as Rates and benefits are approximated. Please call 888-215-4045 for specific plan information. For a complete list of Health Insurance companies in Nevada, please see our Nevada Health Insurance page. (click on the plan names to see more information)

| Plan Name | Cigna PPO Low Plan | Cigna PPO Flex Plan | Cigna PPO High Plan | Cigna PPO Premium Plan |

|---|---|---|---|---|

| PCP Copay | $25 (6 visits limit) | $30 | $30 | $20 |

| Specialist Copay | $50 (6 visits limit) | $60 | $60 | $40 |

| Deductible | $0 | $6,000 | $3,000 | $1,000 |

| Rx: Generic/Brand/High Brand | $10 / NA / NA | $15 / $65 / $100 | $15 / $65 / $100 | $15 /$45 / $85 |

| Premium (single) | $510.00 | $854.50 | $958.00 | $1242.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 (6 visits limit) |

| Specialist Co-pay | $50 (6 visits limit) |

| Rx: Generic/Brand/High Brand | $10 / NA / NA |

| Emergency Room | $350 |

| Hospital Co-pay | $350 |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $0 |

| Max Out of Pocket (single/family) | $7,350 / $14,700 |

| In-Network Co-Insurance | N/A |

| Out-of-Network Benefits | ---------- |

| Deductible | N/A |

| Out of Pocket Max (single/family) | N/A |

| Co-Insurance | N/A |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $25 |

| Renewal Date | 20th of month Prior to Effective date |

| Premium | ---------- |

| Single | $510.00 |

| Couple | $817.00 |

| E+child | $736.25 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $6,000 / $12,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $12,000 / $24,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | --------------------- |

| Single | $854.50 |

| Couple | $1,492.00 |

| E+child | $1,345.50 |

| Family | $1,909.50 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $3,000 / $6,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,000 / $12,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $958.00 |

| Couple | $1,684.00 |

| E+child | $1,516.00 |

| Family | $2,164.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $15/$45/$85 |

| Emergency Room | 20% after deductible |

| Hospital Co-pay | 20% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $1,000 / $2,000 |

| Max Out of Pocket (single/family) | $5,000 / $10,000 |

| In-Network Co-Insurance | 20% |

| Out-of-Network Benefits | ---------- |

| Deductible | $2,000 / $4,000 |

| Out of Pocket Max (single/family) | $10,000 / $20,000 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $20 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $1242.00 |

| Couple | $2,257.00 |

| E+child | $2,018.00 |

| Family | $2,942.00 |

Nevada PPO Plan Carriers

The following list shows the Nevada PPO health insurance plans for 2025. However, they are available to Small Businesses only. If you’re a working individual, freelancer, or self-employed, please get in touch with us to find out the latest PPO plans from individuals.

- Anthem Bluecross Blueshield of Nevada

- Hometown Health Providers

- Prominence Preferred Health

- Sierra Health and Life

- United Healthcare

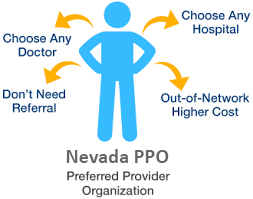

What to Know When Shopping for a Nevada PPO Plan

We have compiled some of the more common concerns when shopping for a Nevada PPO plan.

Are Your Doctors In-Network? – One of the important factors to consider when choosing a health insurance plan is whether your preferred doctor(s) are included in the network. With an NV PPO plan, you have the flexibility to see any doctor you want, but you may pay more for out-of-network services. Therefore, before you sign any contract, make sure you check the network status of your doctor(s) to avoid unexpected costs.

It is important to verify with your doctor and Carrier that they are part of the same in-network plan before you receive any medical services. Do not rely on the answer given by the receptionist, as they may not have the most accurate information. Ask to speak with the office manager, who can confirm that the doctor’s office is participating in your network.

The reason for the caution is that your out-of-network provider may recommend procedures that will probably not be covered by your NV PPO health plan, even if you receive them at an in-network hospital or facility. This means that you will have to pay more out of your pocket for your out-of-network care, as it will only apply to your out-of-network deductible and coinsurance.

Lower Monthly Premium May Result in Higher Costs– Health insurance has a simple life formula: the lower your monthly cost is, the most likely you are going to pay higher costs when you use your health plan. A non-PPO plan may be a suitable option for you if you have a good health condition and no foreseeable medical problems. You can also save money by choosing this type of plan if you rarely need prescription drugs. However, you should be aware of the limitations and costs of non-PPO plans before making a decision.

A PPO health insurance plan indeed lets you choose your own doctors and hospitals. However, you should also consider your medical and prescription needs. A plan with a lower monthly premium may cost you more if you use a lot of health services. Think carefully about your health situation before buying a Nevada PPO plan.

Health Insurance is a contract – The contract between the insurer and the insured is a binding agreement that lasts for a specified period (usually one year). During this time, both parties are expected to fulfill their obligations and responsibilities. If you are dissatisfied with your plan in the middle of the year, you cannot simply request to change your coverage from your insurance company. You need to do your research and select the right plan that meets your needs before signing the contract. However, if you had insurance from a State Marketplace and it expired, you have the option to enroll in an NV PPO health plan mid-year, as long as you are employed.

Types of Insurance Coverage – EPO, HMO, PPO, POS, HDHP, and HSA describe different types of health coverage, that provide you with or without the need for referrals to see specialists and receive out-of-network and out-of-state coverage. Some plans allow you to see specialists without a referral, while others require you to get one from your primary care provider. This can affect your access to care and your out-of-pocket costs. If you often need to see specialists outside your network, you may want a plan that gives you more freedom.

Those of us who travel often for work or those living in multiple states per year might benefit from a Nevada PPO plan, which gives you more flexibility. You can also choose an HDHP or an HSA, which let you save money for medical expenses in a tax-free account. To explore more about these options, please read this article.

Are Essential Health Benefits Covered? – The 10 essential health benefits are a mandatory feature of all Nevada PPO plans. They ensure that you have a basic level of coverage that meets the requirements of the Affordable Care Act. This is important because medical care can be very expensive without insurance and can cause serious financial problems. By having a plan that covers the essential health benefits, you are protected from some of the risks of health care costs.

Most Common Questions Regarding a Nevada PPO Health Insurance Plan

Most Common Questions Regarding a Nevada PPO Health Insurance Plan

How much does a Nevada PPO cost?

PPO Health plans are usually more expensive than other types of plans because of the flexibility that PPO plans provide. Use the table above to see NV PPO rates and shop plans in your state.

Does my doctor accept Nevada PPO Insurance?

Locate and select your company using the list above. Locate the PPO network section once you are on their website. Additionally, you can always contact your doctor’s office. However, it’s best to verify with the health insurance company.

Where can I buy a Nevada PPO health insurance plan?

You can purchase NV PPO plans via local and web broker representatives who can assist you with setting up the plan and aid you in any premium or claims-related issues that you may have during the plan year. It’s always a better option to work with a broker rep that is appointed with all carriers in your region, giving you a better selection to choose a carrier and plan.

How do I qualify for an NV PPO plan?

You need to be either employed, self-employed, or working as a freelancer.

Can I buy an NV PPO plan anytime?

If you are looking for a Nevada PPO health insurance plan, you can enroll at any time of the year. However, you need to submit your application by the 15th of the month if you want your coverage to start on the 1st of the next month. This way, you can enjoy the benefits of a PPO plan that gives you more flexibility and choice in your healthcare providers.

What happens if I’m not happy with my NV PPO health plan, can I change it?

A PPO is a contract, that under most conditions cannot be changed until your PPO plan is up for renewal, usually one year after the start date and often on January 1st. You can change from one NV PPO company mid-year to another company, however, are no plans within the same company.

What makes a PPO plan special?

One of the main benefits of PPO health plans is their flexibility. You have the freedom to choose any healthcare provider you want, in exchange for a higher premium. This is a significant advantage over other plan types, such as HMO plans, which require you to use their in-network providers. PPO plans are especially valuable for people who travel frequently and need access to doctors across the country.

Do I have to be self-employed or part of a group to buy an NV PPO plan?

There two most common ways of getting an NV PPO health plan are: As an employee whose company has a PPO plan option. Others including individuals, freelancers, and sole proprietors need to join a business association that is offering a PPO.

Does the NV State Exchange sell PPO health plans?

Not for Individual health plans. The Exchange does not sell PPO health plans directly, but it does offer other types of plans, such as HMOs, EPOs, and POS plans. These plans may have different rules and costs for accessing providers in and out of the network. For small businesses, yes. Though the range of choices for NV PPO plans is limited.

Do freelancers qualify for NV PPO plans?

Freelancers and sole proprietors are now considered people under the Affordable Care Act, which means they must join a business organization that provides Nevada PPO health plans in order to obtain an eligible NV PPO plan.

Can seniors 65 and older qualify for a PPO plan?

Yes, seniors can choose to keep their current plan rather than enroll in Medicare if they work for a company that offers a PPO option. A Nevada PPO plan would not be available to someone who is not employed.

Are NV PPO plans offered as short-term medical plans?

Yes, short-term PPO plans are an option for some people, but they are not the same as comprehensive health insurance plans. They may have limited benefits and coverage. Before buying a short-term PPO plan, read the summary of benefits carefully.

Why do PPO plans cost more than other types of health plans like HMOs?

One of the factors that affect the price of PPO plans is their network size and quality. PPO plans allow you to choose any provider, but they offer lower costs if you use providers that are in their network. These providers are often selected for their expertise and reputation, and they receive higher payments from the PPO plan. This means that PPO plans have higher premiums than HMO plans, which require you to use only network providers. If you want more freedom and access to top-notch care, you may prefer a PPO plan, but if you want to save money and don’t mind having a limited choice of providers, you may opt for an HMO plan.

Why are there more hospitals and doctors signed up in a typical PPO plan than in non-PPO plans?

PPO network members enjoy access to select doctors and hospitals that receive above-average reimbursement rates from national health insurance companies. These providers usually reject the lower rates of other plans, such as HMOs.