Shop Affordable Ohio PPO Plans in all 88 Counties

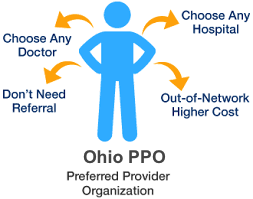

Are you shopping for an Ohio PPO plan? If you want to learn more about the Ohio PPO health insurance market and how to compare OH PPO rates, you’ve come to the right place. At Vista, we have extensive experience with PPOs and plan options. We’ll provide you with all the information you need to help you choose the best Ohio PPO plan for your needs.

Are you shopping for an Ohio PPO plan? If you want to learn more about the Ohio PPO health insurance market and how to compare OH PPO rates, you’ve come to the right place. At Vista, we have extensive experience with PPOs and plan options. We’ll provide you with all the information you need to help you choose the best Ohio PPO plan for your needs.

Ohio PPO Rates for 2024

Ohio PPO Rates for 2024

The following is a table of Common individual Ohio PPO plans, including rates and benefits. This information is approximated so it’s suggested that you call for specific plan information

| Plan Name | PCP Copay | Specialist Copay | Deductible | Rx: Generic/Brand/High Brand | Premium (single) |

|---|---|---|---|---|---|

| PPO Low Plan | $15 | $40 | $5,000 / $10,000 | $0 / NA / NA | $490.04 |

| PPO Flex Plan | $20 | $60 | $5,000 / $10,000 | $0 / 25% / 50% all after deductible | $862.00 |

| PPO High Plan | $40 | $60 | $2,500 / $6,750 | $0 / 25% / 50% | $1,047.00 |

| PPO Premium Plan | $25 | $35 | $350 / $700 | $0 / 25% / 50% | $1,287.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $15 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $0 / NA / NA |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% copay after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,000 / $14,000 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $40 |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $490.04 |

| Couple | $1,021.29 |

| E+child | $860.85 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% all after deductible |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | --------------------- |

| Single | $862.00 |

| Couple | $1,660.00 |

| E+child | $1,435.00 |

| Family | $2,080.00 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $40 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $2,500 / $6,750 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,750 / $13,500 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,047.00 |

| Couple | $2,214.00 |

| E+child | $1,799.00 |

| Family | $2,689.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 |

| Specialist Co-pay | $35 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $350 / $700 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $700 / $1,400 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 35% |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,287.00 |

| Couple | $2,639.00 |

| E+child | $2,222.00 |

| Family | $3,352.00 |

Ohio PPO Insurance Carriers

Below you’ll find the list of carriers that currently offer Ohio PPO health insurance plans for sale in 2024, for Small Businesses. Due to market changes, only select carriers have made plans available to working individuals, Freelancers, and sole proprietors. Feel free to give us a call for the latest carrier information.

- Aetna

- Ambetter

- Anthem Blue Cross Blue Shield of Ohio

- Cigna

- Humana

- Medical Mutual of Ohio

- Molina Healthcare

- Oscar Health Insurance Plan

- Paramount Insurance

- SummaCare Inc of Ohio

- United HealthCare of Ohio

What to Know When Shopping for an Ohio PPO Insurance Plan

We have compiled some of the most common concerns when shopping for an Ohio PPO health insurance plan.

Are Your Doctors In-Network? – Before buying a health insurance plan you should always ensure that your doctor(s) are part of the network even if OH PPO plans will cover out-of-network services. Visiting an out-of-network doctor may cost substantially more than if the doctor is in-network.

Before you enroll in a certain insurance plan, make sure to check with both the doctor’s office and the insurance carrier or a carrier agent that your doctors are in-network. This is important because if an out-of-network provider recommends a service, then all of the care provided by that doctor will be considered out-of-network, even if the facilities and doctors are in-network. With an OH PPO health plan, your out-of-network services will apply to your out-of-network deductible.

Lower Monthly Premium Can Result in Higher Costs – The amount you pay monthly for health insurance is inversely related to the amount you pay at the point of service. Lower monthly premiums indicate higher costs when using the insurance, while higher monthly premiums result in lower costs at the point of service. Consider your health condition and expected healthcare needs when choosing a plan. Opt for a lower-cost plan if you are generally healthy, but select a higher-cost plan if you have a chronic condition or frequent medical expenses. When comparing Ohio PPO health insurance plans, evaluate your current health situation and projected healthcare needs.

Health Insurance is a Contract – The contract between you and the insurance company is binding for both parties for a specified period of time (usually one year). You are responsible for choosing the appropriate plan that suits your needs before signing the contract. You cannot request a change in coverage during the year if you are dissatisfied with your plan. However, if you have lost or terminated your State Marketplace plan, you have the option to enroll in an OH PPO health plan mid-year as long as you are employed.

Types of Insurance Coverage – Different types of health insurance plans include EPO, PPO, POS, HMO, HDHP, and HSAs. These plans have different features regarding the freedom and coverage to see providers who are not in your network or who are located in another state. They also vary in whether you need a referral from your primary care physician to see a specialist. You may benefit from a plan that offers more flexibility and coverage for out-of-network specialists if that is your usual situation.

If your work requires frequent travel or you reside in different states throughout the year, you may want to consider an Ohio PPO plan that provides such flexibility. The other two plan options, HDHP and HSA, are authorized by the government and enable you to establish a tax-exempt savings account that is specifically intended to cover eligible medical expenses.

Are Essential Health Benefits Covered? – All Ohio PPO plans include the 10 essential health benefits. These benefits ensure that the insured have access to quality health care services, as required by the Affordable Care Act. The essential health benefits are important because health care can be very expensive and without adequate insurance, it can cause serious financial problems for a family. By offering essential health benefits, the PPO plans protect the insured from unexpected medical costs.

Most Common Questions Regarding an Ohio PPO Health Plan

Most Common Questions Regarding an Ohio PPO Health Plan

How much does an Ohio PPO cost?

Ohio PPO Health plans are most often more expensive than other plan types due to the flexibility that PPOs provide. Use the table above to see OH PPO rates and shop plans in your state

Does my doctor accept Ohio PPO Insurance?

To find the right network for your plan, follow these steps:

– Look at the list of health carriers on this page and click on your company name.

– On your company’s network page, check if there is a section for PPO network.

– If you are not sure if your doctor is in the PPO network, you can call their office and ask. However, the most reliable way to confirm is to contact your health insurance company directly.

Where can I buy an Ohio PPO health insurance plan?

OH PPO Health plans provide flexible and affordable coverage options for individuals and groups. They are available through qualified broker representatives who can help customers find the best plan for their needs and budget. Broker reps also offer ongoing support and assistance with premium payments and claims processing. Customers should look for a broker rep who has access to multiple carriers and plans in the region, so they can compare and choose the most suitable option.

How do I qualify for an OH PPO plan?

OH PPO plans are designed for individuals who work in various capacities, such as employees, self-employed professionals, or freelancers. To be eligible for an OH PPO plan, the applicant must meet one of these criteria and provide proof of income and occupation.

Can I buy an OH PPO plan anytime?

Yes. OH PPO health plans are available to go into effect at the beginning of the month during the year. You should complete your application by the 15th of the current month to have the coverage begin on the 1st of the following month.

I’m not happy with my OH PPO health plan, can I cancel and get a new one?

Since your PPO is a contract, you cannot change your plan until your PPO plan renews, usually one year from the start date. You can switch OH PPO plans mid-year as long as you change to a different insurance company.

What makes a PPO plan special?

PPO plans offer a lot of flexibility and convenience for the insured. They do not require referrals from primary care physicians to see specialists or other providers. You have the freedom to choose any doctor or hospital that you prefer. This is a significant advantage over EPO or HMO plans, which limit your choices to their network of providers. This is especially important for people who travel frequently and want to have access to quality care anywhere in the country.

Do I have to be self-employed or part of a group to buy a PPO plan?

There are two main options for obtaining an OH PPO health plan. One option is to work for an employer that provides a PPO as part of its company plan. Another option is to join a business association that offers a PPO to its members. This option is suitable for individuals, freelancers, and sole proprietors who need health coverage.

Can I get a PPO from the State Exchange or healthcare.gov?

There are no individual PPO options available on the state exchanges or healthcare.gov. The only plan types for sale are EPOs and HMO plans. Small businesses do have a few PPO options on the exchanges, however, they are limited.

Do freelancers qualify for OH PPO plans?

Since the ACA was established, freelancers are classified as individuals, and that means they must become part of a business association that is offering an Ohio PPO health plan to be eligible for insurance.

Would I qualify for a PPO plan if I am age 65 or older?

If employees of a business are age 65 or older, they have the option to keep their OH PPO health insurance plan instead of signing onto Medicare. If that senior is not working for a company, then they’re eligible for an Ohio PPO plan.

Are PPO plans offered as short-term medical plans?

Yes. If a prospective insured is considering a short-term medical plan, there are PPO Plans available, unfortunately, many short-term medical plans are not true health insurance plans so be sure to review the summary of benefits.

Why do PPO plans have higher rates than other health plans like HMOs?

Ohio PPO plans offer flexibility and convenience when it comes to choosing your healthcare providers. They cover a higher percentage of the costs for services from doctors and hospitals outside the network, compared to HMO plans that limit your coverage to in-network providers. However, this benefit comes with a higher price tag, as PPO plans typically have higher premiums and deductibles than HMO plans. This is the trade-off for having access to any provider in the nation.

Why do PPO networks have more hospitals and doctors than non-PPO networks?

Some doctors and hospitals in Ohio receive higher payments from insurance companies to join their PPO plans. These providers may not agree to the lower payments of other plans, such as HMOs, but they may accept the PPO plans. This is how insurance companies create their PPO networks in Ohio.