Shop Affordable Texas PPO Plans in all 254 Counties

Are you currently exploring Texas PPO plans for your health insurance needs? Do you wish to gain a deeper understanding of the Texas PPO health insurance market and compare different rates available in TX? Below, you will discover essential resources to aid you in making an informed decision when choosing the ideal Texas PPO plan that suits your requirements.

Are you currently exploring Texas PPO plans for your health insurance needs? Do you wish to gain a deeper understanding of the Texas PPO health insurance market and compare different rates available in TX? Below, you will discover essential resources to aid you in making an informed decision when choosing the ideal Texas PPO plan that suits your requirements.

Texas PPO Health Insurance Rates for 2024

Texas PPO Health Insurance Rates for 2024

Below, you’ll find a table featuring Texas PPO options with estimated rates, office copays, deductibles, and prescription benefits. For comprehensive plan details, please reach out to our office using the contact number provided above.

| Plan Name | PCP Copay | Specialist Copay | Deductible | Rx: Generic/Brand/High Brand | Premium (single) |

|---|---|---|---|---|---|

| PPO Low Plan | $15 | $40 | $5,000 / $10,000 | $0 / NA / NA | $490.04 |

| PPO Flex Plan | $20 | $60 | $5,000 / $10,000 | $0 / 25% / 50% all after deductible | $862.00 |

| PPO High Plan | $40 | $60 | $2,500 / $6,750 | $0 / 25% / 50% | $1,047.00 |

| PPO Premium Plan | $25 | $35 | $350 / $700 | $0 / 25% / 50% | $1,287.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $15 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $0 / NA / NA |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% copay after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,000 / $14,000 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $40 |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $490.04 |

| Couple | $1,021.29 |

| E+child | $860.85 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% all after deductible |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $5,000 / $10,000 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $10,000 / $20,000 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | --------------------- |

| Single | $862.00 |

| Couple | $1,660.00 |

| E+child | $1,435.00 |

| Family | $2,080.00 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $40 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $2,500 / $6,750 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,750 / $13,500 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 30% after deductible |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,047.00 |

| Couple | $2,214.00 |

| E+child | $1,799.00 |

| Family | $2,689.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 |

| Specialist Co-pay | $35 |

| Rx: Generic/Brand/High Brand | $0 / 25% / 50% |

| Emergency Room | 30% after deductible |

| Hospital Co-pay | 30% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $350 / $700 |

| Max Out of Pocket (single/family) | $8,200 / $16,400 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $700 / $1,400 |

| Out of Pocket Max (single/family) | Unlimited |

| Co-Insurance | 50% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision and Dental |

| Mental/Substance | 35% |

| Renewal Date | 12/31/2024 |

| Premium | ---------- |

| Single | $1,287.00 |

| Couple | $2,639.00 |

| E+child | $2,222.00 |

| Family | $3,352.00 |

Texas PPO Insurance Carriers

Here is the updated list of carriers offering Texas PPO health insurance plans for Small Businesses in 2024. Please note that specific carriers cater to employed individuals, freelancers, and the self-employed. For the most current and accurate carrier information, we recommend giving us a call. We’ll be happy to assist you further.

- Aetna

- Ambetter

- Blue Cross Blue Shield of Texas

- Cigna

- CHRISTUS

- FirstCare Health Plans

- Humana

- Molina HealthCare

- Oscar Health Insurance Plan

- Scott & White Health Plan

- United HealthCare of Texas

What Everyone Should Consider Before Buying a Texas PPO Health Insurance Plan

Are Your Doctors In-Network – While the purpose of a PPO is to allow you the freedom to go to non-network providers, it’s always a good idea to see if your current physicians are part of the network. If not, it just means that when you do visit those doctors for care, you will be charged an out-of-network rate, even though as we said, TX PPO plans will cover out-of-network services.

Many individuals prefer to contact their doctor’s office and inquire with the first available person when seeking information. However, it is essential not to solely rely on the doctor’s office to determine whether they participate in specific insurance plans before enrolling. It is crucial always to verify with the insurance company or an agent to ensure that your doctors are part of the network.

The reason for this caution is that if a healthcare provider outside of your insurance network suggests services, all those services provided by that particular doctor will be considered out of network, even if the facilities and other providers involved are in-network. This can have significant implications, especially when you have a TX PPO health plan, as any medical services obtained from out-of-network providers will count towards your out-of-network deductible. Therefore, being aware of your doctors’ network status is vital to manage your healthcare expenses effectively.

Lower Monthly Premium Can Result in Higher Costs – Opting for a lower monthly premium can sometimes lead to higher overall costs, and this principle applies to various aspects of life, including health insurance. Choosing a plan with a lower premium might seem like a money-saving decision initially, but it could result in higher expenses when you actually need to use the insurance. On the other hand, paying more for a plan upfront could prove more cost-effective in the long run.

To make the best decision, it’s essential to assess your current health condition and family medical history. If you are generally in good physical health, rarely require prescriptions, and don’t foresee significant health-related expenses, a lower-cost health insurance plan may be a suitable choice for you. However, if you anticipate higher medical costs and frequent prescription usage, investing in a higher-priced plan might save you money in the future.

Always take into account your health status and family history as crucial factors when exploring Texas PPO health insurance plans to ensure you make an informed choice that aligns with your specific needs.

Health Insurance is a Contract – Once you sign a contract, it becomes legally binding, and you are obligated to abide by its terms. If, at any point, you discover that you are dissatisfied with your TX PPO Insurance plan, you cannot approach the carrier in the middle of the year to request a policy change. To avoid such undesirable circumstances, it’s wise to ask for a summary of benefits and seek clarification before enrolling in a plan.

However, there is an exception to this rule. If you are employed and lose your coverage, you have the option to visit your state marketplace and purchase individual health insurance plans. It’s worth noting that, unfortunately, there are no TX PPO plans available for purchase on the exchange.

Types of Insurance Coverage – Various health plan designs include HMO, PPO, POS, EPO, HDHP, and HSA. The first four are the most prevalent, drawing inspiration from the traditional insurance plans introduced by national BlueCross and Kaiser. These plans vary in their policies regarding specialist visits, referrals, and out-of-network or out-of-state care. If you frequently require medical specialists who are not part of the plan’s network, it’s essential to opt for a more flexible option like a TX PPO plan to accommodate your needs effectively.

If you find yourself traveling and residing in multiple states each year, a Texas PPO plan would be worth considering, as it provides the desired flexibility across different states. Alternatively, HDHP and HSAs offer the option to establish tax-free savings accounts dedicated to qualified medical expenses. For more in-depth information on these coverage types, please refer to the following article.

Are Essential Health Benefits Covered? – Yes, all Texas PPO plans are required to include the 10 essential health benefits, which ensure a minimum level of coverage for the insured. These benefits are set as a standard and requirement under the Affordable Care Act. Having a minimum standard level is crucial because the expenses associated with medical treatment can be exorbitant and may lead to financial devastation without insurance coverage.

By guaranteeing that a plan includes the 10 essential health benefits, it fulfills the primary purpose of health insurance: to restore the insured’s well-being and protect them from the overwhelming costs of medical care.

Most Common Questions Regarding a Texas PPO Health Plan

Most Common Questions Regarding a Texas PPO Health Plan

How much does a Texas PPO cost?

Texas PPO Health plans are almost always more expensive than other plan types, due to the flexibility that PPO plans provide. Use the table above to see TX PPO rates and call for additional information.

Does my doctor accept Texas PPO Insurance?

To determine if your doctor accepts Texas PPO Insurance, follow these steps: Refer to the list of health insurance companies provided above and find your company. Access their network directory and look for the PPO section. Moreover, consider calling your doctor’s office and speaking with the office manager. Share the name of your insurance company and the specific plan to inquire about their acceptance of it.

Where can I buy a Texas PPO health insurance plan?

If you’re looking to purchase a Texas PPO health insurance plan, brokers are the primary and most common resource. Brokers can not only help you compare and select a suitable health plan but also provide assistance throughout the plan year with any issues that may arise, such as claims, payments, and other potential problems.

Do I qualify for a TX PPO plan?

To become eligible for a TX PPO plan, you typically need to meet specific criteria set by the insurance provider. The qualifications may include factors such as being employed, self-employed, or a freelancer. It’s essential to check with the insurance company or a licensed broker to determine the precise requirements for obtaining a Texas PPO plan. They can guide you through the process and help you understand the qualifications based on your individual circumstances.

Can I buy a TX PPO plan anytime?

Yes, you can purchase a TX PPO plan anytime. Texas PPO plans typically offer a start date on the 1st of the month. As long as you submit the necessary paperwork before the 15th of the prior month, you should have no issues obtaining an effective date that starts on the 1st of the following month. This flexibility applies throughout the year.

What happens if I’m not satisfied with my TX PPO health plan, can I switch plans anytime?

If you are dissatisfied with your TX PPO health plan, changing it might not be possible until your plan’s renewal period. Health contracts typically run from the beginning of the year until the end of the year, but the specific dates may vary based on your contract. To explore your options, get in touch with your broker to inquire about the possibility of changing your plan and the renewal date.

However, you do have an alternative. You can select a different company that offers TX PPO plans and start a new plan with them. Before making any changes, it’s essential to contact the company to ensure the feasibility of this option.

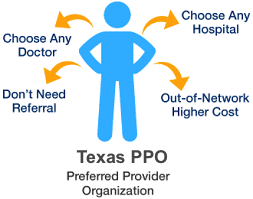

What makes a PPO plan special?

A PPO plan stands out for its extensive network of healthcare providers, offering more flexibility to choose doctors and specialists without referrals. It also provides partial coverage for out-of-network services, although with higher costs. This plan’s key features are greater autonomy in healthcare decisions, a wider provider selection, and the option to seek out-of-network care at a higher cost.

Must I be self-employed or part of a group to buy a PPO plan?

Access to a TX PPO health plan can be achieved through two traditional methods. The first is by being an employee of a company that provides a PPO plan. The second option is available for freelancers and sole proprietors, who can join an association offering a PPO plan. Additionally, certain working individuals may also qualify for a PPO plan under specific conditions.

Can I purchase a Texas PPO Health insurance plan through healthcare.gov?

Not for Individual health coverage, Your closest option is an EPO and that doesn’t offer you the most important aspect of a PPO which is out-of-network usage. HMO plans are also offered on the Federal Exchange and many State Exchanges. For a small business, yes PPO options are available, though they are limited.

Do freelancers qualify for TX PPO plans?

The significance of being considered a freelancer has diminished since the implementation of the Affordable Care Act. Freelancers are now categorized as individuals for health insurance purposes. To acquire a PPO plan, you would need to become a member of an association that provides Texas PPO plans.

Can seniors age 65 and above qualify for a PPO plan?

If you’re 65 and above and employed and the company contracts with a PPO plan then yes, as long as you remain employed you can opt to continue with that plan and choose not to be covered under Medicare. Be sure to check with your company because there are rules relative to company size. Those that are 65 and older that are not employed would not qualify for a TX PPO Plan.

Can PPO plans be offered as short-term medical plans?

Yes. Short-term plans contract with PPO networks, like Cigna, Aetna, and UnitedHealthcare. Unfortunately, most of those short-term plans don’t cover you for the 10 essential health benefits and that means they’re not true health insurance plans Be sure to always read the summary of benefits thoroughly before signing up for a plan.

What makes a PPO plan a more expensive health plan as compared to other types of plans like HMOs?

The determining factor for the overall cost of a health plan lies in the coverage it provides. In the case of a PPO plan, the ability to seek out-of-network services on a national level contributes to its cost. Since not all hospitals offer the same level of care, individuals with complex medical conditions often prefer to choose the best hospital and providers that can effectively address their specific needs.

I see that there are a larger number of hospitals and doctors in PPO plans, why is that?

PPO plans are contractual agreements, and the insurance companies responsible for them offer higher reimbursement rates to specific doctors and hospitals in order to include them in their PPO network. These top-tier healthcare providers, being highly skilled and reputable in their field, demand fair compensation for their services and, as a result, may not accept the reimbursement levels offered by plans such as HMOs and EPOs.