Affordable PPO Health Insurance Plans

Looking for cheap PPO insurance or a more affordable health plan that doesn’t sacrifice flexibility? You’re not alone. PPO plans are popular because they let you see doctors without referrals and get care out of network, but they’re often pricier than HMOs. The good news? Some PPO plans are designed for budget-conscious shoppers, offering lower premiums while still covering what matters most.

For self-employed professionals seeking savings, our Self-Employed PPO Health Insurance guide covers affordable plans tailored for freelancers, consultants, and sole proprietors.

On this page, we’ll compare the best low-cost PPO health insurance plans of 2025 and explain what trade-offs to expect, so you can make a smart decision without overpaying. If you’re new to PPOs, visit our PPO Health Insurance Guide for a complete overview.

What Makes a PPO Plan ‘Affordable’?

When we talk about affordable PPO plans, we’re not talking about stripped-down coverage. Instead, these plans balance monthly premiums and deductibles to help you control costs while preserving core PPO benefits like out-of-network coverage and provider choice.

- Lower monthly premiums – Keep more money in your pocket upfront.

- Higher deductibles – Pay more only if you need frequent care.

- HSA-compatibility – Use tax-free savings to cover medical costs.

- Lean networks or limited extras – But still flexible compared to HMOs.

PPO vs HMO: When Cheaper Is Still Better

HMO plans usually offer the lowest premiums, but they come with strict network rules and limited flexibility. Affordable PPOs might cost a bit more, but for many people, they strike a better balance between price and freedom. Want to explore more plan types? Check out our plan comparison guide.

| Feature | Affordable PPO | HMO |

|---|---|---|

| Specialist Access | No referral needed | Referral required |

| Out-of-Network Coverage | Partial reimbursement | Rare or emergency only |

| Monthly Premium | $$ | $ |

| Flexibility | High | Low |

If you value seeing any provider without jumping through hoops, and don’t mind a higher deductible when needed, an affordable PPO may be the smarter choice over a limited HMO.

Best Affordable PPO Plans (2025)

Below are examples of popular PPO plans that balance affordability with flexibility. Each option varies in deductible, network size, and compatibility with Health Savings Accounts (HSAs).

| Plan Name | Monthly Premium | Deductible | HSA-Compatible | Network Size | Best For |

|---|---|---|---|---|---|

| ValuePPO Basic | $295 | $6,000 | Yes | Nationwide | Healthy individuals |

| FlexCare Saver | $340 | $4,500 | Yes | Multi-State | Freelancers & gig workers |

| PPO Select Budget | $390 | $2,800 | No | Regional | Families on a budget |

Trade-offs to Consider

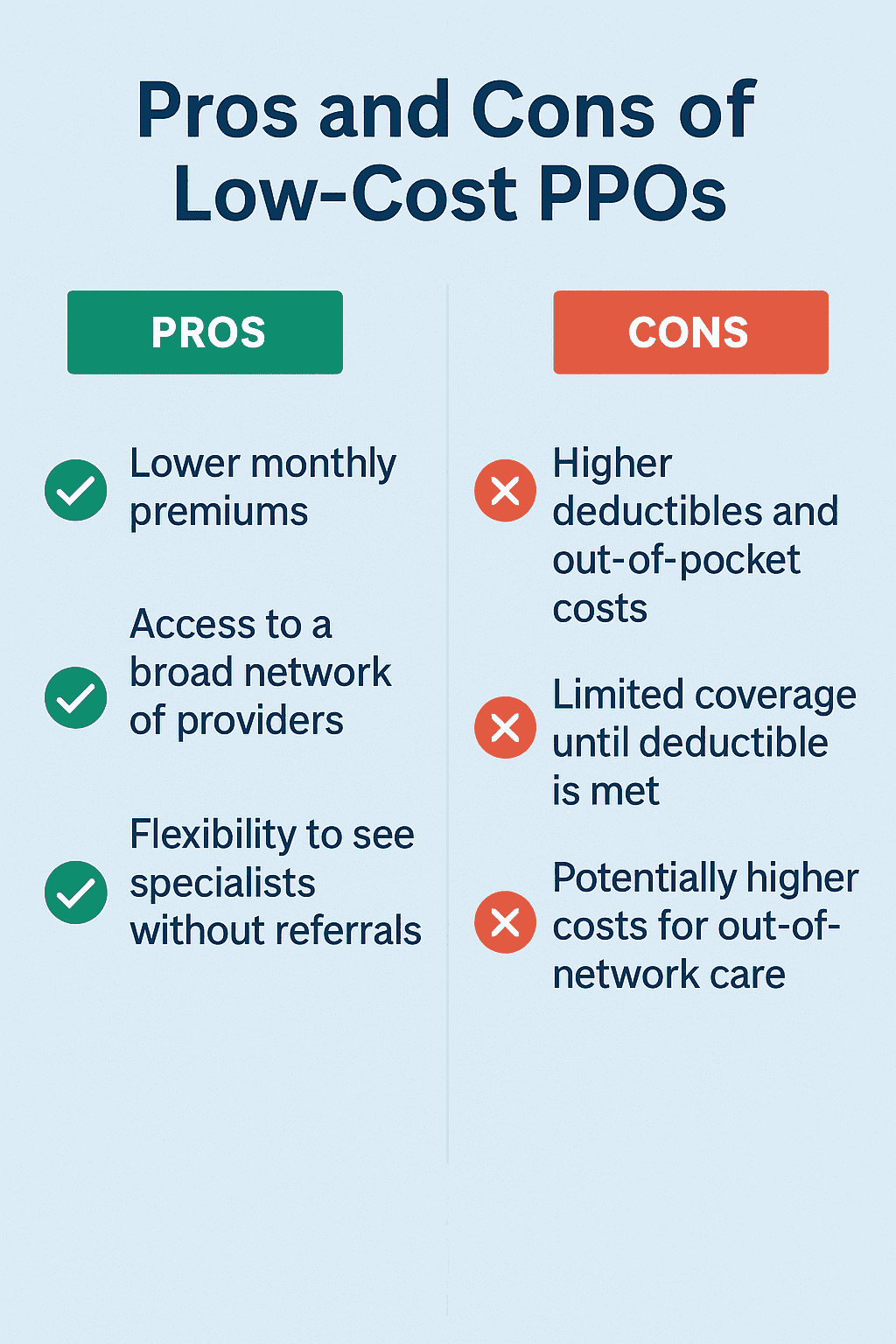

Affordable PPOs can be a smart financial move, but it’s important to weigh the trade-offs so you’re not caught off guard. Here’s what you might be giving up in exchange for lower monthly premiums:

- Higher deductibles – You may need to pay more out of pocket before coverage begins.

- Coinsurance and copays – You’ll likely split more costs when care is needed.

- Balance billing risk – Out-of-network visits may lead to extra charges.

- Fewer extras – Some budget plans exclude perks like telehealth or wellness incentives.

Still, for healthy individuals or those who prefer flexibility over frills, these trade-offs can be well worth it.

For independent professionals weighing coverage vs. cost, we’ve outlined affordable PPO plans for self-employed individuals that prioritize flexibility without breaking your budget.

When NOT to Choose an Affordable PPO

While low-cost PPOs work well for many, there are a few situations where they may not be the best fit:

- Chronic health conditions: If you expect frequent doctor visits, tests, or medications, a plan with a lower deductible and richer benefits may reduce your total costs.

- Planned major procedures: Surgery, maternity, or hospital stays can lead to high out-of-pocket spending on budget plans.

- Need for enhanced extras: Features like telehealth, fitness perks, or brand-name drug coverage are sometimes limited in budget-tier PPOs.

In these cases, it may be worth paying more monthly for broader protection and greater peace of mind.

Real User Stories

“As a freelance web developer, I needed a plan that didn’t lock me into a narrow network. The budget PPO I found gave me flexibility without breaking the bank.”

– Alex M., Seattle

“I run a small photography business and work in multiple states. The HSA-compatible PPO was perfect for me. I use pre-tax dollars and still see the doctors I want.”

– Danielle K., Austin

“I travel constantly as a contract nurse. Finding a low-cost PPO with out-of-network options made all the difference for staying covered nationwide.”

– Janelle T., Tampa

How to Compare Affordable PPO Plans

When reviewing low-cost PPO options, use this checklist to find the right balance of cost and coverage:

- Monthly premium: Does it fit your monthly budget?

- Deductible: Are you comfortable with the amount you must pay before coverage kicks in?

- Out-of-pocket max: What’s the most you’d spend annually?

- Network access: Can you keep your current providers?

- HSA eligibility: Will the plan work with a Health Savings Account?

- Out-of-network benefits: Are you covered if you travel or move?

Is an Affordable PPO Right for You?

The answer depends on how often you use healthcare and how much flexibility matters to you. Here are a few common scenarios where a budget-friendly PPO might make sense:

- Healthy freelancer who visits the doctor only for preventive care, low monthly cost with PPO flexibility.

- Gig worker or 1099 contractor who needs a national provider network due to frequent travel or multiple residences.

- The cost-conscious family that wants provider freedom without paying for extras they rarely use.

While these plans may not offer every perk, they preserve the features PPO users value most: nationwide access, specialist choice, and fewer gatekeeping rules.

Frequently Asked Questions

What’s the cheapest PPO plan?

The cheapest PPO plans usually have higher deductibles and fewer extras but offer core benefits like out-of-network access.

Are low-cost PPOs worth it?

They can be a smart choice for healthy individuals or those who value network flexibility and don’t expect frequent care.

Can I use an HSA with an affordable PPO?

Yes, many low-cost PPOs are HSA-compatible, giving you tax advantages on out-of-pocket spending.

How do I qualify for a low-cost PPO plan?

Anyone can apply, but eligibility and pricing vary by location, age, and provider network availability.

Related Guides

- Best PPO Plans of 2025 – See which plans perform best across price, network, and perks.

- PPO vs HMO vs EPO vs POS – Learn how PPOs compare to other plan types before you decide.

- PPOs for Self-Employed & Freelancers – Flexible options tailored for 1099 workers and solopreneurs.

- What Is a PPO Plan? – Understand the core benefits of PPO coverage before comparing.

Next Steps: Compare Affordable PPO Options

Now that you understand what makes a PPO plan affordable and what trade-offs to consider, it’s time to find the best option for your budget and health needs. Use our comparison tool to explore plans tailored to your location and preferences.