Best PPO Health Insurance in Texas (2025)

Explore top-rated PPO health plans in Texas with the flexibility to see any doctor, nationwide networks, and fewer referral hassles. Compare your options and find the best PPO for your needs in 2025.

Texan comparing PPO health plan options on a laptop at home

What Makes a PPO Plan the Best?

PPO (Preferred Provider Organization) plans are known for offering greater freedom when choosing healthcare providers. Unlike HMOs, PPOs don’t require referrals and often include large regional or national networks.

- Freedom to visit any in-network or out-of-network doctor

- No referral needed to see a specialist

- Ideal for frequent travelers, self-employed, and families wanting provider flexibility

Top PPO Health Insurance Providers in Texas

Here are some of the leading PPO providers offering coverage across Texas:

- Blue Cross Blue Shield of Texas: Offers statewide health insurance networks with strong coverage

- UnitedHealthcare: Extensive health insurance plans with national reach and digital health tools

- Cigna: Competitive health insurance plans for individuals, families, and employers

Best PPO Plans by Profile

| Profile | Recommended PPO Type | Key Features |

|---|---|---|

| Families | BCBS Texas Blue Advantage PPO | Broad pediatric network, predictable costs |

| Self-Employed | UnitedHealthcare Choice Plus | Tax-deductible premiums, HSA options |

| Frequent Travelers | Cigna PPO | National coverage, digital provider access |

Pros and Cons of Choosing a PPO Plan in Texas

- ✅ Pro: Broad provider network across Texas and the U.S.

- ✅ Pro: No referrals needed for specialists

- ✅ Pro: Good for second opinions and specialized care

- ❌ Con: Higher monthly premiums than HMOs

- ❌ Con: Some out-of-network care may involve balance billing

Is a PPO Plan Right for You?

PPO plans are well-suited for individuals and families who prioritize provider choice and convenience. You might benefit from it if:

- You travel frequently or split time between multiple states

- You want access to specialists without referrals

- You live in a rural area where provider networks are limited

- You see out-of-network providers and want partial reimbursement

- You are a retiree seeking health insurance in Texas who wants out-of-network access and travel flexibility.

If you’re unsure, our licensed brokers can help match you to the right plan for your circumstances.

PPO vs HMO vs EPO: Quick Comparison

| Feature | PPO | HMO | EPO |

|---|---|---|---|

| Referrals Required | No | Yes | No |

| Out-of-Network Coverage | Yes | No | No |

| Monthly Premium | Higher | Lower | Mid |

How to Compare PPO Health Plans in Texas

When evaluating health insurance options, consider these factors:

- Monthly premiums vs deductible and out-of-pocket max

- Size and location of the provider network

- Out-of-network coverage and reimbursement

- Compatibility with Health Savings Accounts (HSAs)

Need a side-by-side comparison? Visit our Texas PPO Health Insurance page for more detailed plan breakdowns.

Top PPO Plans by Region in Texas

Your location can influence which plans are most accessible and affordable. Here are examples of top-rated PPOs by region:

- Dallas–Fort Worth: BCBS Texas Blue Advantage PPO and UnitedHealthcare Choice Plus

- Houston: Cigna PPO and Ambetter PPO (where available)

- Austin & Central TX: BCBS, Aetna PPO, and Cigna networks

- South Texas: Coverage options may be more limited—seek PPOs with telehealth and travel networks

Emerging Trends in PPO Plans for 2025

Texas PPO offerings continue to evolve with consumer demand and regulatory changes. Key trends include:

- More HSA-Compatible PPOs: Helping self-employed Texans manage tax savings

- Expanded Telehealth Services: Especially valuable in rural regions

- Increased Out-of-Network Benefits: Some plans now offer partial reimbursement outside the state

- Hybrid PPO/EPO Options: Offering PPO-style flexibility with lower EPO pricing

Working with a broker ensures you’re seeing the latest 2025 options that fit your health needs and budget.

How to Enroll in a PPO Plan in Texas

You can enroll in a PPO plan during Open Enrollment (Nov 1–Jan 15) or when you qualify for a Special Enrollment Period. Common life events that trigger SEP eligibility include losing coverage, moving, marriage, or having a child.

To apply, you’ll need basic information like your household income, ZIP code, and preferred doctors or prescriptions. A licensed broker can help you compare available plans and complete your enrollment at no additional cost.

Related Guides

Frequently Asked Questions

What is the difference between PPO and HMO plans in Texas?

PPO plans offer more provider flexibility and do not require referrals. HMO plans typically have lower premiums but require members to stay in-network and get referrals for specialists.

Are PPO plans more expensive in Texas?

Generally yes. PPOs tend to have higher monthly premiums but offer broader access and out-of-network coverage that HMOs and EPOs don’t.

Can I use a Texas PPO plan while traveling out of state?

Yes, most PPOs—especially those from national carriers—include out-of-state providers in their network or offer reimbursement for out-of-network care.

Real-World Example: PPO Coverage for a Traveling Texan

Consider Maria, a freelance consultant based in Dallas who frequently travels to Austin and Houston. With a PPO plan, she can see her primary care doctor in Dallas and visit specialists in other cities without a referral. Even when traveling out of state for business, her national network gives her access to care without needing to switch plans. This flexibility and peace of mind make PPOs especially valuable for mobile professionals and multi-location families.

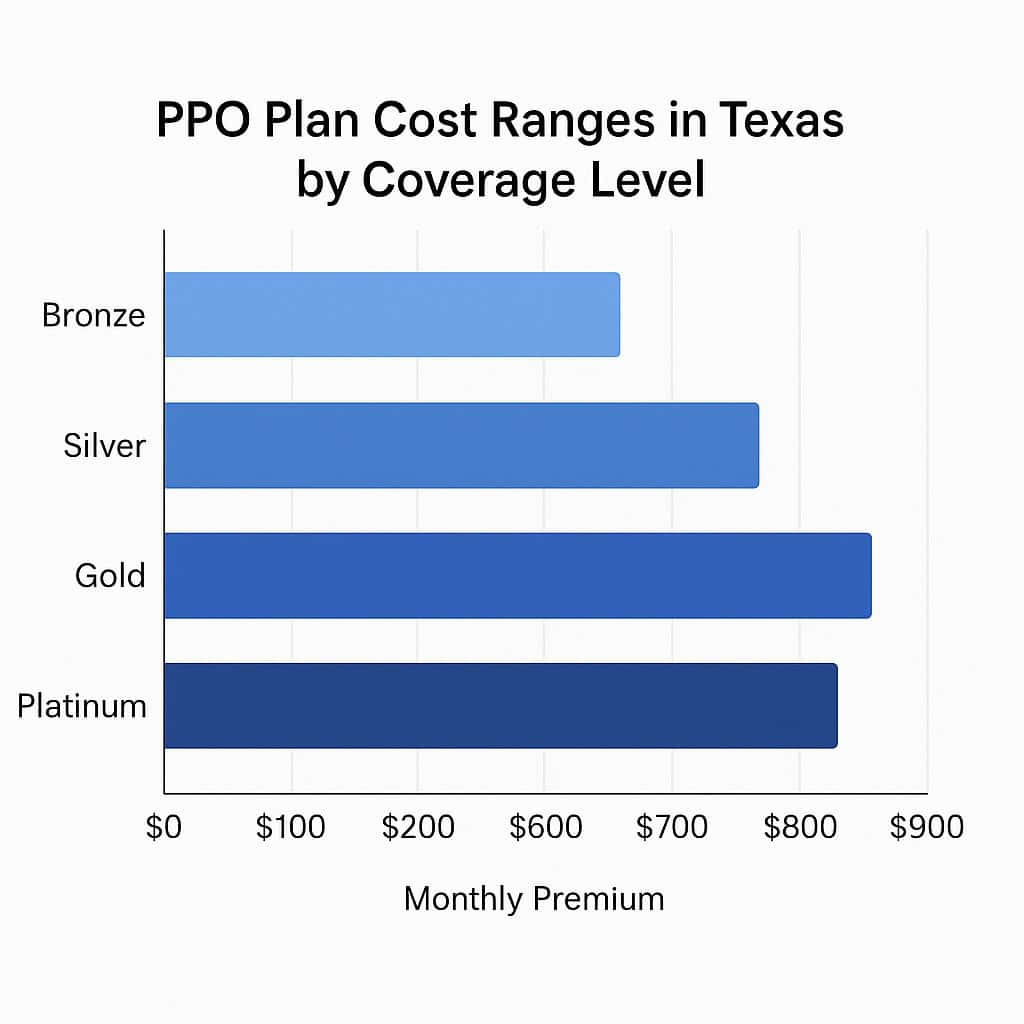

PPO Plan Costs in Texas: What to Expect

Premiums for PPO plans vary based on age, region, and coverage level. Below are estimated monthly premiums for a 40-year-old in Texas:

- Basic Plan: $420–$520/month

- Mid-Tier Plan: $530–$670/month

- High-Coverage Plan: $680–$790/month

Bar chart showing PPO plan cost ranges in Texas by coverage level

Marketplace PPOs vs Bronze & Silver Plans

Some PPO plans are offered on Healthcare.gov in Texas, typically as Bronze or Silver tiers. These may have lower premiums but often mean higher deductibles and smaller networks. If you qualify for subsidies, marketplace options can work well, but many quality PPO choices are also available off the exchange.

Compare PPO Plans Available Near You

Our quoting tool helps you compare health insurance plans from top carriers based on your ZIP code, age, and household size. Whether you want to keep your doctor, lower your out-of-pocket costs, or explore nationwide networks, we can help you find the right fit.