Catastrophic Health Insurance in Texas

Looking for ultra-low-cost coverage in Texas? Catastrophic health insurance might seem appealing, especially if you’re under 30 or qualify for a hardship exemption. These high-deductible plans offer a safety net against worst-case scenarios, but come with big trade-offs. As brokers, we help you weigh catastrophic plans against better-value alternatives like Bronze ACA or PPO plans, so you don’t sacrifice protection for savings.

Unlike many websites, we break down not only how catastrophic plans work, but whether they actually make financial sense in the Texas marketplace. With deductibles nearing $9,500 and no subsidy eligibility, catastrophic insurance can sometimes cost more in the long run than a subsidized Bronze or Silver plan.

In today’s economic climate, many Texans are tempted by the low sticker price of catastrophic plans. But smart insurance decisions involve more than monthly premiums. If you’re trying to balance cost and coverage, we’ll help you understand where catastrophic insurance fits and where it falls short.

What Is Catastrophic Health Insurance?

Catastrophic plans are ACA-compliant policies that cover essential benefits after you meet a high deductible. In 2025, the deductible is $9,450 for an individual. These plans are designed for young, healthy individuals who want protection from major emergencies without paying high monthly premiums.

They include free preventive care and three primary care visits per year, but offer little to no help with regular medical costs until you hit the deductible.

Who Qualifies for Catastrophic Coverage in Texas?

- Texans under age 30 automatically qualify

- Texans over 30 can apply with a federal hardship exemption

- Hardship examples: eviction, bankruptcy, domestic violence, unaffordable premiums

You must apply for the exemption through Healthcare.gov or submit documents to the Marketplace. Once approved, you’ll see catastrophic plans available in your quote options.

What’s Covered (and Not Covered)?

Catastrophic plans include the ACA’s 10 essential health benefits, after you meet the deductible. Before that point, coverage is extremely limited.

- ✅ Emergency hospital care

- ✅ Preventive services & annual wellness visits

- ✅ Three primary care visits annually (pre-deductible)

- ❌ Mental health, prescriptions, and labs until deductible is met

- ❌ No dental or vision unless included by the insurer

Cost of Catastrophic Plans in Texas

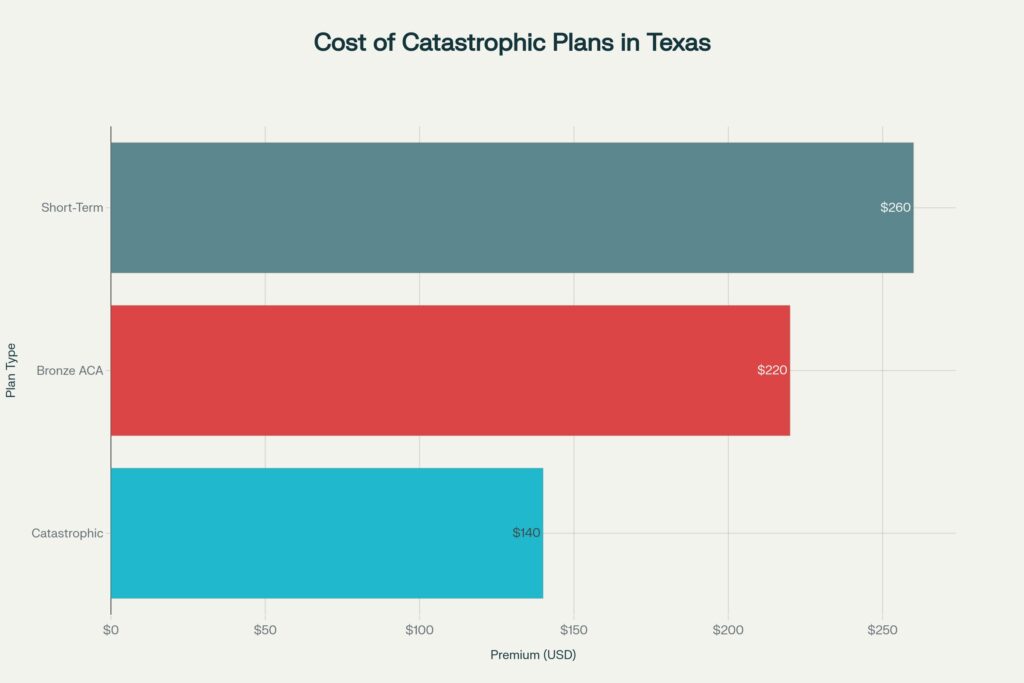

For a healthy 28-year-old in Texas, catastrophic plans can range from $120 to $230/month, depending on ZIP code and carrier. But the deductible remains steep $9,450 in 2025, with no cost-sharing help until that threshold is met.

In many cases, ACA Bronze plans with subsidies or private PPOs may offer better real-world value. These plans often provide earlier coverage for prescriptions, doctor visits, and labs, with deductibles that qualify for cost-sharing reductions.

Catastrophic vs Bronze vs Short-Term Plans

| Feature | Catastrophic | Bronze ACA | Short-Term |

|---|---|---|---|

| Monthly Premium | Lowest | Moderate | Low |

| Deductible | Highest ($9,450) | High | Varies |

| Pre-Existing Condition Coverage | Yes | Yes | No |

| ACA Subsidy Eligible | No | Yes | No |

| Enrollment Limits | Yes | Yes | Yes |

This table compares Catastrophic, Bronze ACA, and Short-Term plans, outlining their premiums, deductibles, pre-existing condition coverage, subsidy eligibility, and enrollment limits.

When Catastrophic Plans Backfire

While catastrophic plans can look attractive, many Texans are surprised by how little help they offer in real medical situations. If you visit a doctor for a sudden illness or need labs or prescriptions, you’ll pay 100% of the cost out of pocket until you meet the full deductible. For most people, that’s close to $10,000.

We’ve worked with clients who expected basic services like blood work or urgent care to be covered, only to face unexpected bills. If your income qualifies you for ACA subsidies, catastrophic plans may leave you worse off financially than a standard Bronze or Silver plan.

Who Should Avoid Catastrophic Insurance?

Catastrophic plans are not a good fit for everyone. If you’re low-income and qualify for premium tax credits, a Bronze or Silver plan can cost less while providing earlier coverage. Texans with chronic health conditions, prescription needs, or ongoing care are better off with a more robust plan. Self-employed individuals may also benefit from PPO options with more provider flexibility.

How to Enroll in a Catastrophic Plan in Texas

You can enroll during the standard Open Enrollment period (Nov 1 – Jan 15) or via a Special Enrollment Period if you qualify. Texans over 30 must apply for a hardship exemption through Healthcare.gov before catastrophic plans appear as an option. If you’re unsure whether you qualify or which plan fits your health and financial situation, our licensed brokers can help you navigate your eligibility.

Real Story: Sofia’s Catastrophic Plan Mistake

Sofia, a 27-year-old freelancer in Austin, picked a catastrophic plan because it had the lowest premium. But when she needed X-rays and physical therapy after a bike accident, she discovered he had to pay everything until reaching the $9,450 deductible. After talking to one of our brokers, she switched to a Bronze PPO plan that saved him money overall and gave him access to more providers.

Better Alternatives from a Broker

Many Texans shop for catastrophic insurance, assuming it’s the cheapest. But depending on your income and medical needs, other plans might make more sense. Our brokers help you compare:

- Bronze or Silver ACA plans with subsidies

- Private PPO plans with lower out-of-pocket limits

- Short-term coverage if you’re between jobs

We can also review your eligibility for cost-sharing reductions or special enrollments based on income or life events. Many clients are surprised to learn they qualify for more coverage than they expected, at a lower net cost. Our brokers also help assess provider networks and hospital access so you can avoid surprise bills down the road.

FAQs: Catastrophic Health Insurance Texas

Who qualifies for catastrophic health insurance in Texas?

Texans under 30 or those who receive a federal hardship exemption.

What is the deductible for catastrophic plans in 2025?

$9,450 for an individual. You must pay this before major benefits kick in.

Can I use subsidies on a catastrophic plan?

No. Subsidies do not apply to catastrophic coverage. Consider Bronze or Silver instead.

Do catastrophic plans cover preventive care?

Yes. All ACA plans include preventive services and three primary care visits per year.

Can I switch to a different plan later?

Yes, during Open Enrollment or if you qualify for a Special Enrollment Period.

Choosing the Right Low-Cost Coverage in Texas

Catastrophic plans offer the lowest monthly cost, but may not be the best overall value. Let our Texas-based brokers help you explore ACA plans with subsidies, PPOs with provider freedom, and other smart options. We’ll compare pricing, eligibility, and networks so you can make a confident decision. Don’t let a cheap premium blind you to what’s missing; get expert help before you enroll.