High-Deductible PPO Plans: Are They Worth It?

High-deductible PPOs offer the flexibility of a traditional PPO with lower premiums, but they come with more financial risk. This guide will help you decide when it makes sense to choose one and how to avoid common mistakes. Curious how PPOs work overall? Read our full PPO health insurance guide.

If you’re self-employed and considering a high-deductible PPO, explore our Self-Employed PPO Health Insurance guide for options that support HSA contributions and flexible care access.

What Is a High-Deductible PPO Plan?

A high-deductible PPO (HDHP) is a type of Preferred Provider Organization plan with a deductible higher than $1,600 for individuals or $3,200 for families (2025 IRS baseline). These plans let you use any provider in-network without referrals, but you’ll pay most costs out of pocket until you meet your deductible.

After meeting the deductible, your plan typically begins covering a portion of your care through coinsurance, often 70–80%, until you hit the out-of-pocket maximum. For example, if you need an MRI that costs $1,800 early in the year, you may have to pay that full amount before your plan starts paying anything. That’s why understanding the financial trade-offs is essential.

Why Some People Choose High-Deductible PPOs

- Lower monthly premiums compared to standard PPOs

- Eligibility to open and contribute to a Health Savings Account (HSA)

- Ideal for healthy individuals or those who rarely use medical services

- Appealing to higher-income earners seeking tax-advantaged savings

When a High Deductible Might Hurt You

These plans aren’t a good fit for everyone. You might want to avoid a high-deductible PPO if:

- You have a chronic condition or require frequent specialist visits

- Your budget can’t cover a $3,000+ bill unexpectedly

- You plan to have a baby, surgery, or other high-cost care this year

Who Should Absolutely Avoid an HDHP

Some people may face more risk than reward with a high-deductible PPO. If any of these describe your situation, a standard PPO or ACA Silver/Gold plan may be a better fit:

- Low-income earners who don’t have savings to cover unexpected care

- Families with small children or ongoing pediatric needs

- Individuals who manage multiple chronic conditions or medications

- Caregivers supporting older adults or relatives with complex medical needs

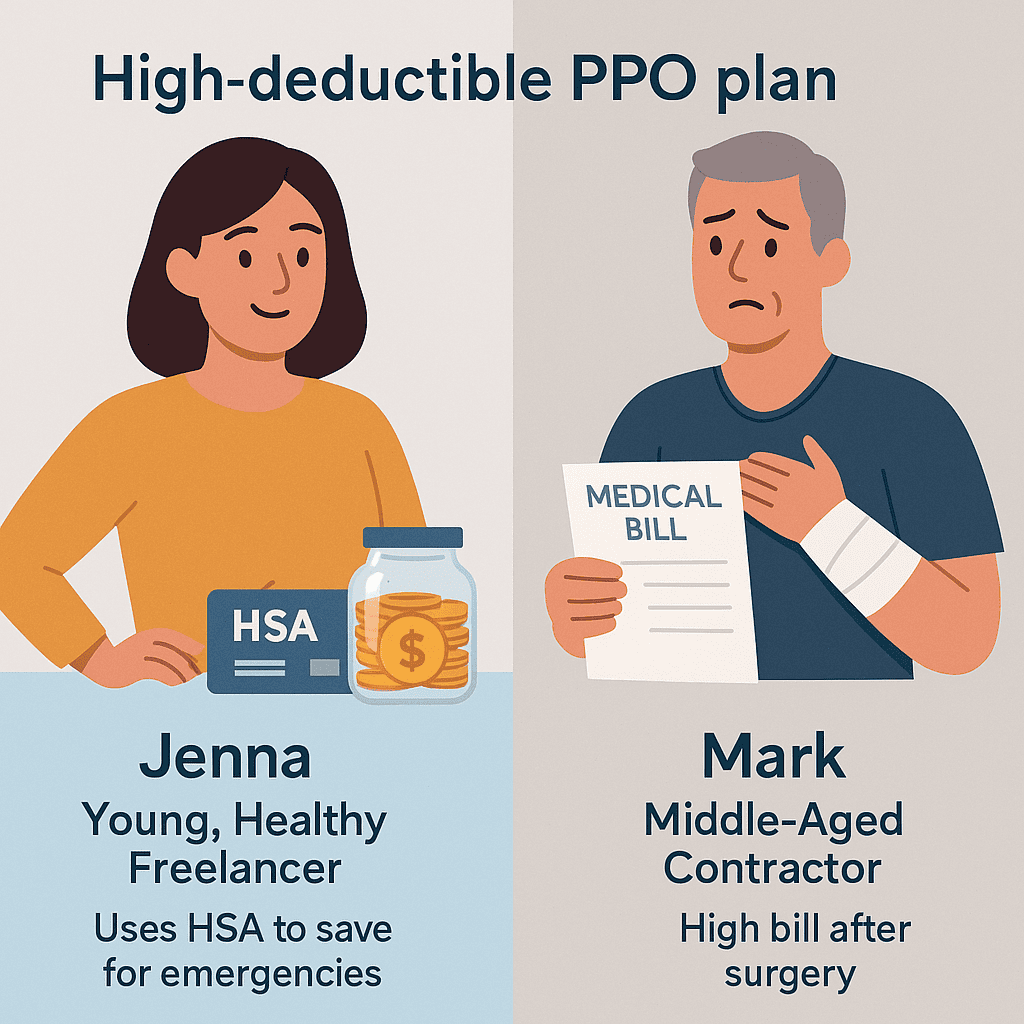

Real-Life Example: Two Freelancers, Two PPOs

Jenna is a healthy 28-year-old freelancer. She chose a high-deductible PPO with a $0 premium through her association. She uses her HSA to save $3,000 a year tax-free and hasn’t met her deductible once.

Mark is a 40-year-old contractor who had back surgery last spring. His high-deductible PPO left him with a $6,200 bill before coinsurance kicked in. He now wishes he had chosen a traditional PPO with a higher premium but lower out-of-pocket limits.

Should You Pair It with an HSA?

Most high-deductible PPOs are HSA-eligible. This means you can:

Want to learn how to maximize your HSA savings and stay compliant with IRS rules? Read our full Health Savings Account (HSA) guide.

- Save money tax-free for medical expenses

- Invest unused funds over time

- Use funds for vision, dental, and even some mental health services

- Roll over your balance each year, no “use it or lose it”

Self-employed professionals often opt for high-deductible PPO plans due to their HSA compatibility. Learn more in our Self-Employed PPO Health Insurance guide.

Need Help Comparing Plans?

Whether you’re looking for savings, flexibility, or long-term value, we can help you compare high-deductible PPOs with traditional options.

HDHP vs Bronze, Silver & Gold Plans

High-deductible PPOs aren’t the same as Bronze-tier plans on the ACA marketplace, though they’re often confused. Here’s how they differ from metal-tiered plans:

| Feature | HDHP PPO | ACA Bronze/Silver/Gold |

|---|---|---|

| Deductible | $1,600+ (individual) | Varies by tier; Silver/Gold are lower |

| HSA Eligible | Yes | Usually No |

| Premiums | Low | Low to High |

| Best For | Healthy, high-income, tax-savvy | Income-based subsidy users |

Is It Smart to Switch Mid-Year?

Most people can’t switch out of a high-deductible PPO plan mid-year unless they have a Qualifying Life Event (QLE). Examples of QLEs include marriage, divorce, birth or adoption of a child, or relocation. If you’re thinking of switching, know that:

- Missed enrollment windows can leave you stuck until the next Open Enrollment

- Your deductible may reset when you change plans

- You could lose access to HSA contributions mid-year

Questions to Ask Before Choosing One

- Can I afford to pay my full deductible out-of-pocket?

- Is preventive care covered pre-deductible?

- Are prescriptions affordable under this plan?

- Does the plan offer telehealth and virtual support?

Pros and Cons Recap

- Pros: Low premiums, HSA access, tax advantages, flexibility

- Cons: Higher risk of large bills, no coverage until deductible met, harder for families with frequent needs

High-Deductible PPOs for Self-Employed & 1099 Workers

If you’re self-employed or a 1099 contractor, a high-deductible PPO can be a smart way to keep monthly costs down, especially if you rarely need care. You may also qualify for a deduction on HSA contributions, making this option even more attractive.

However, irregular income can make high deductibles risky. One medical bill could wipe out your cash flow. Before enrolling, make sure you have emergency savings or access to credit.

Explore more tips in our guide to PPO plans for freelancers and 1099 workers.

Frequently Asked Questions

Are high-deductible PPOs available on the ACA marketplace?

Yes. Many HDHP PPOs are offered through the ACA marketplace, especially in Bronze or Catastrophic categories — but always verify that the plan is truly HSA-compatible.

Do HDHPs count as minimum essential coverage?

Yes. A qualified HDHP counts as minimum essential coverage under the ACA, as long as it’s a major medical plan that includes the 10 essential benefits.

Can I still see specialists with a high-deductible PPO?

Yes. PPOs — even high-deductible ones — allow you to see specialists without a referral, but you’ll likely pay full price until the deductible is met.

Do HDHPs cover preventive care before the deductible?

Yes. Under federal ACA rules, preventive care like checkups and screenings must be covered at no cost, even before the deductible is met.

What is considered a high-deductible PPO in 2025?

For 2025, an individual plan with a deductible of at least $1,600 qualifies as a high-deductible health plan (HDHP). Family thresholds start at $3,200.

Are high-deductible PPOs eligible for HSAs?

Yes. If a high-deductible PPO meets IRS guidelines, it qualifies for HSA contributions.

Can I switch out of a high-deductible PPO mid-year?

Usually no, unless you have a qualifying life event (QLE) like marriage, birth, or relocation.

Related Guides

- Explore low-cost PPO options with higher deductibles

- See if a high-deductible PPO fits your self-employed needs

- Compare plan types and how deductibles impact coverage

Need Help Choosing the Right PPO?

We specialize in helping freelancers, independent contractors, and small business owners compare high-deductible and traditional PPO plans side by side.