Nationwide PPO Plans: What to Know Before You Buy

When people search for a “nationwide PPO plan,” they’re usually looking for health insurance that travels with them, across state lines, between homes, or throughout the country for work or family. But what does “nationwide” actually mean when it comes to PPO health insurance? Let’s unpack the truth behind the label so you can make a smarter decision before enrolling. Learn more about how PPO plans work.

Why Nationwide Coverage Matters

When people search for a “nationwide PPO plan,” they’re usually looking for health insurance that travels with them, across state lines, between homes, or throughout the country for work or family. But what does “nationwide” actually mean when it comes to PPO health insurance? Let’s unpack the truth behind the label so you can make a smarter decision before enrolling.

Why Nationwide PPOs Appeal to Certain Professions

Some careers and lifestyles make nationwide coverage not just a convenience, but a necessity. Professionals who travel for work, relocate seasonally, or work remotely often benefit most from nationwide PPOs. Examples include:

- Traveling consultants with out-of-state clients

- Truck drivers who cross multiple states weekly

- Travel nurses on assignment throughout the country

- Freelancers or remote tech workers who move between coworking hubs

- See our guide to PPO plans for freelancers and 1099 workers

- Business owners with teams or operations in several states

- Read about PPO options for the self-employed

Top Carriers Offering National PPO Networks

- Cigna Open Access PPO: Broad network, often includes telehealth

- Aetna PPO: Common in employer and association plans

- UnitedHealthcare PPO: Known for strong national access and digital tools

- Blue Cross Blue Shield: BlueCard PPO system offers multi-state access in many employer plans

Note: Many of these are only available through employer-sponsored or association health plans. Not all are on the ACA marketplace.

Nationwide PPO vs Local PPO vs EPO Plans

Here’s a quick side-by-side comparison of plan types:

| Feature | Nationwide PPO | Local PPO | EPO |

|---|---|---|---|

| Network Size | National | Regional | Regional |

| Out-of-State Care | In-network access | Usually out-of-network | Emergency only |

| Referrals Needed | No | No | No |

| Premium Cost | Higher | Moderate | Lower |

| Best For | Travelers, nomads, multi-state families | People who live and get care in one region | Budget-conscious individuals |

Explore our comparison of PPO vs HMO vs EPO vs POS plans.

Common Myths About Nationwide PPOs

- Myth: All PPOs are nationwide.

Truth: Many PPOs only operate regionally or within state lines. - Myth: Out-of-network means no coverage.

Truth: PPOs often provide partial reimbursement for OON care, but at higher costs. - Myth: Nationwide means every doctor is covered.

Truth: Even national plans have network exclusions. Always check the provider directory.

Need Help Choosing the Right PPO?

Not sure which PPOs are truly nationwide or whether your doctor is in-network? Our licensed agents can help you compare plans and avoid costly surprises.

Questions to Ask Before Buying

- Does the provider directory span all 50 states?

- Are telehealth and remote RX included in-network?

- Will I pay more for preventive care out of state?

- Is there tiered pricing or different deductibles for out-of-region use?

- Are there exclusions in the lab, imaging, or mental health network?

How Nationwide PPOs Handle Telehealth & Prescriptions

One of the biggest perks of nationwide PPO plans is their flexibility in how and where care is delivered. Many nationwide PPOs include strong telehealth benefits, allowing you to consult with doctors remotely, refill prescriptions, or manage chronic conditions from anywhere in the country. If you’re traveling or living temporarily in another state, this access can be invaluable.

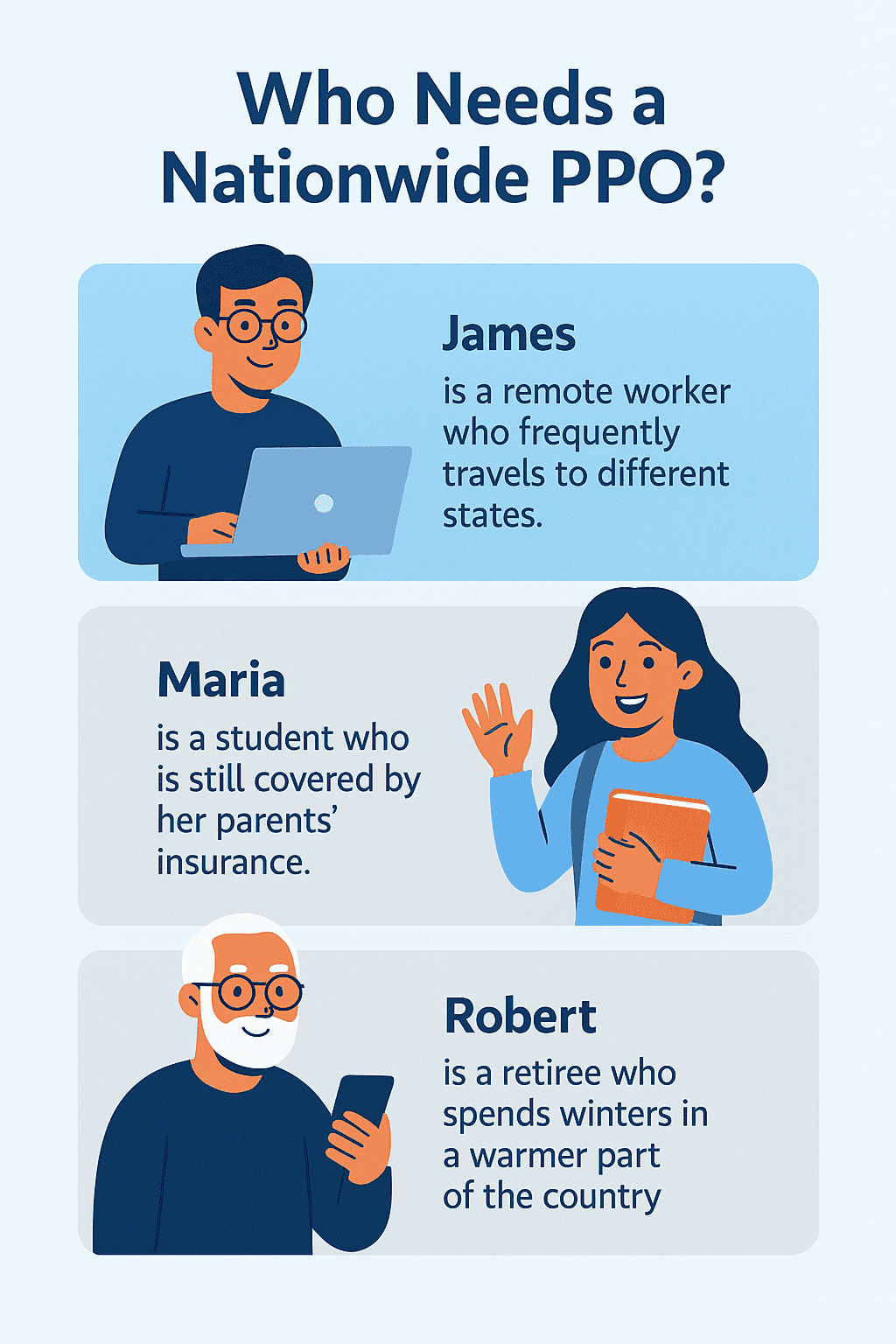

Real-World Example: Brian’s Mid-Year Move

Brian started the year in Colorado, enrolled in a nationwide PPO plan through his freelance association. When he relocated to Texas in June, he was still able to access in-network doctors, continue his physical therapy sessions, and manage his prescriptions, all without needing to change plans or networks. For mobile professionals like Brian, a true nationwide PPO provided seamless coverage during a transitional life change.

Pros and Cons of Nationwide PPOs

Before you decide, weigh the biggest advantages and drawbacks of choosing a nationwide PPO plan:

- Pros: True multi-state access, broad provider network, no referrals needed, excellent for mobile or remote lifestyles.

- Cons: Typically higher premiums, possible tiered benefits or exclusions by state, and harder to find on individual marketplaces.

Who Might Want to Avoid These Plans?

Nationwide PPOs aren’t ideal for everyone. Some groups may benefit more from local or regional plans:

- People with limited budgets who prioritize low premiums over national access

- Those who live, work, and receive care entirely within one state or region

- Anyone eligible for Medicaid or low-income subsidies via a state marketplace

Additional FAQs

Do I need a referral for a nationwide PPO?

No. One of the main benefits of PPOs — including nationwide ones — is that you can see specialists without a referral.

Can I use my PPO if I move out of state?

If your PPO has nationwide network access (and is not tied to an employer region), you may be able to keep using it. Always verify with the insurer.

Do PPOs work for temporary relocations?

Yes. Nationwide PPOs are ideal for seasonal workers, digital nomads, and snowbirds who spend months at a time in different states.

What’s the difference between a national network and national availability?

“National availability” means the plan can be sold in multiple states. “National network” means you can access in-network care across state lines — a crucial distinction when shopping for a true nationwide PPO.

Is a Nationwide PPO Worth It?

It depends on your lifestyle and risk tolerance. Nationwide PPOs tend to have higher premiums, but they offer peace of mind and flexibility that regional or HMO/EPO plans can’t match. For freelancers, remote workers, and business owners who value access anywhere, they’re often worth the added cost. Even if you live and work in just one city, a nationwide PPO can provide peace of mind and access to top specialists around the country.

How to Shop Smart for a Nationwide PPO

- Work with a licensed broker who can verify network access

- Ask to see the provider directory before enrolling

- Be cautious of buzzwords like “national” or “multi-state” without details

- Check for extra tools like telehealth and mobile claims support

- Confirm that in-network providers are truly available in the places you visit most

- Watch out for regional lab or pharmacy carve-outs that limit convenience

Related Guides

- Understand PPO flexibility across state lines

- Stay covered on the move with national provider networks

- Explore top plans with national access

Ready to Explore Nationwide PPO Options?

We specialize in health insurance for remote workers, multi-state households, and independent professionals who need true flexibility.