Self-Employed PPO Health Insurance

If you’re self-employed and want a plan that prioritizes choice and convenience, Self-Employed PPO Health Insurance offers the flexibility to see doctors nationwide with fewer restrictions. Unlike tightly managed plans, PPOs are designed for independent professionals who need coverage that moves with them, from local specialists to out-of-state care.

This guide explains how PPOs work for freelancers, contractors, consultants, and solo business owners, including costs, out-of-network access, plan tiers, and how to compare options. You’ll also find real user stories, answers to common questions, and clear next steps to get a free quote.

Why PPOs Work Well for the Self-Employed

Self-employed professionals value control over where and how they receive care. With Self-Employed PPO Health Insurance, you can visit in-network providers for lower costs, and still use out-of-network providers when needed. You don’t need referrals to see specialists, and large national networks make it easier to get care where you live or travel for work.

For many independent workers, this flexibility outweighs the typically higher premiums compared with HMOs or EPOs. If you prioritize provider choice, direct access to specialists, and multi-state coverage, a PPO is often the most practical fit.

Related reading: Learn how PPOs compare to other plan types in our in-depth guide PPO vs. HMO vs. EPO vs. POS, and visit the PPO Health Insurance pillar for a complete overview.

Who Should Consider a PPO?

Self-Employed PPO Health Insurance is a strong match for:

- Freelancers, independent contractors, and consultants

- Solo business owners who want nationwide access

- Digital nomads and frequent travelers who cross state lines

- Parents and caregivers who want direct access to specialists

- Older adults seeking broader provider choice without referrals

If you’ve ever delayed care because your preferred doctor wasn’t in-network, or you travel often for projects, the flexibility of a PPO can protect both your schedule and your health.

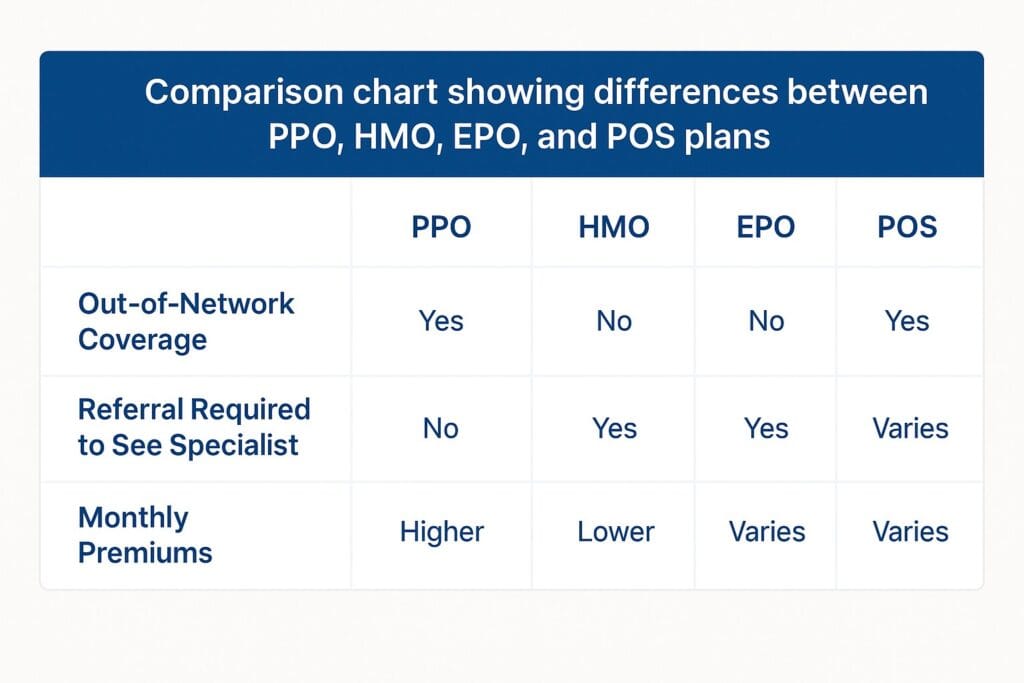

PPO vs. HMO, EPO, and POS Plans

Compared with HMOs, PPOs typically offer larger networks and never require a primary care referral to see specialists. EPOs and POS plans sit in the middle, often restricting out-of-network care or requiring more coordination. If your priority is the freedom to choose, Self-Employed PPO Health Insurance is usually the most flexible model.

Still deciding? Our comparison page, PPO vs. HMO vs. EPO vs. POS, covers real-world trade-offs so you can match a plan type to your usage, doctors, and travel patterns.

Out-of-Network Coverage: When It Matters

Out-of-network access is a core advantage of Self-Employed PPO Health Insurance. You’ll typically pay more when seeing non-network providers, but having the option can be essential if you live in a rural area, work on location in different states, or need a specific specialist who isn’t in-network.

Tip: Ask each plan how balance billing, preauthorization, and out-of-network deductibles are handled. These details can materially affect your out-of-pocket costs.

How Much Do PPO Plans Cost?

Self-Employed PPO Health Insurance generally costs more than HMO or EPO options, reflecting the added flexibility. Your total cost includes monthly premiums, deductibles, coinsurance, copays, and an annual out-of-pocket maximum. Pricing varies by state, age, and coverage level.

- Premiums: Often higher, but offset by broader access and no-referral specialist visits.

- Deductibles: Commonly in the mid-range; evaluate how they pair with coinsurance.

- Out-of-pocket maximums: Key for budgeting worst-case scenarios.

- Copays/coinsurance: Vary by tier and network status (in vs. out of network).

We’ll help you review carrier options, compare PPO network depth, and estimate total annual costs under realistic usage, not just the monthly premium.

Compare PPO Plans for Self-Employed Professionals

Let us help you find the right PPO coverage. Speak to a licensed agent today to review your options and secure coverage that fits your needs.

Call (888) 215-4045Real-World Example: Why PPOs Work

Imagine a video producer who travels frequently for client shoots. With Self-Employed PPO Health Insurance, he can see in-network providers in major cities and still get covered care out-of-network in a pinch, without chasing referrals. The result is predictable access wherever work takes him.

How to Qualify and Enroll

You don’t need an employer group to enroll in Self-Employed PPO Health Insurance. Options include private plans, association-based PPOs, and in some markets, ACA-compliant PPOs. Enrollment timing depends on the channel:

- ACA Marketplace PPOs: Generally available during the annual Open Enrollment Period or if you have a Qualifying Life Event (QLE).

- Private PPO options: Often available year-round, subject to underwriting and plan rules.

We’ll ask a few basics, like age range, state, and anticipated usage, then guide you through plan comparisons and enrollment. If an HSA-compatible PPO fits your tax strategy, we’ll map that out too.

What to Ask When Comparing PPO Plans

- How broad is the in-network provider list where I live and travel?

- What are the deductibles, copays, and coinsurance for key services?

- Are telehealth and virtual urgent care covered at a low copay?

- What’s the out-of-pocket maximum for worst-case budgeting?

- How are out-of-network claims handled, including balance billing?

For a deeper dive into plan design trade-offs, visit our PPO Health Insurance page, and compare top carriers in Best PPO Health Insurance Plans (2025) to help you make a confident decision.

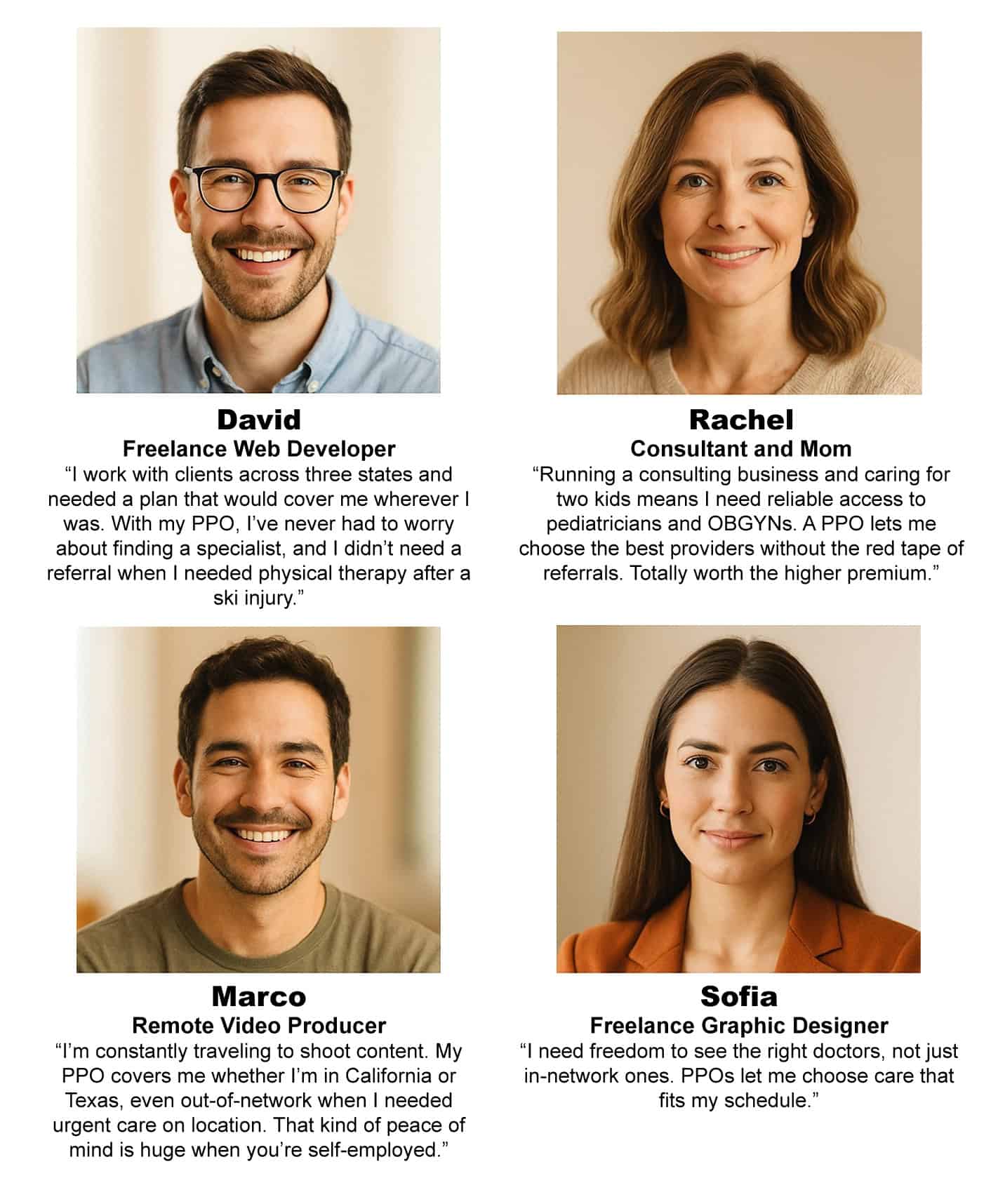

Real User Stories

📌 David – Freelance Web Developer

“I work with clients across three states and needed a plan that would cover me wherever I was. With my PPO, I’ve never had to worry about finding a specialist — and I didn’t need a referral when I needed physical therapy after a ski injury.”

📌 Rachel – Consultant and Mom

“Running a consulting business and caring for two kids means I need reliable access to pediatricians and OBGYNs. A PPO lets me choose the best providers without the red tape of referrals. Totally worth the higher premium.”

📌 Marco – Remote Video Producer

“I’m constantly traveling to shoot content. My PPO covers me whether I’m in California or Texas — even out-of-network when I needed urgent care on location. That kind of peace of mind is huge when you’re self-employed.”

📌 Sofia – Freelance Graphic Designer

“I need freedom to see the right doctors, not just in-network ones. PPOs let me choose care that fits my schedule.”

Frequently Asked Questions

Do self-employed people qualify for PPO plans?

Yes. Most PPO plans are available through private markets, and you don’t need a group or employer to qualify.

Are PPOs more expensive than other plans?

Generally yes, but they offer more provider access and flexibility, which can be crucial if you see specialists or travel frequently.

Can I write off my PPO health insurance premiums?

Many self-employed individuals can deduct their health insurance premiums, including PPOs, from their taxable income. Always confirm with a tax advisor.

Understanding PPO Plan Tiers

When shopping for a PPO plan, you’ll often see options labeled Bronze, Silver, Gold, or Platinum. These tiers reflect how you and the insurance company split costs, not the quality of care.

- Bronze: Lower premiums, higher deductibles. Best for catastrophic coverage or low usage.

- Silver: A balance between cost and coverage. Popular among self-employed individuals.

- Gold/Platinum: Higher monthly premiums but lower out-of-pocket costs. Ideal if you use healthcare often.

Our licensed agents can help you weigh the pros and cons of each tier to ensure your plan aligns with your budget and health needs.

Take the Next Step

At ForHealthInsurance, we understand the unique challenges of being self-employed. From navigating costs to understanding plan differences, our advisors are here to help. Call today and let us make the process simple and stress-free.

Call (888) 215-4045