PPO vs HMO vs EPO vs POS: Health Insurance Plan Comparison 2025

Understanding the differences between health insurance plan types helps you choose coverage that matches your lifestyle, budget, and healthcare needs. Compare network flexibility, referral requirements, and costs to make an informed decision.

Health Insurance Plan Types: Making the Right Choice

Choosing the right health insurance plan starts with understanding your options. Each plan type—PPO, HMO, EPO, and POS—offers different rules for accessing care, choosing providers, and managing costs. If you pick a plan that doesn’t match your lifestyle or health needs, you could face unexpected bills or network limitations. Understanding how PPO health insurance plans compare to other options helps you make smart coverage decisions that protect both your health and your budget.

Each health insurance plan type operates under different guidelines for choosing doctors, accessing specialists, and receiving out-of-network care. Some prioritize low costs through managed care, while others maximize flexibility with broader provider access. The key is matching plan features to your specific needs, travel patterns, and healthcare usage. When comparing best PPO health insurance plans against other options, consider both immediate costs and long-term flexibility to ensure your coverage adapts to changing life circumstances.

PPO – Preferred Provider Organization

Best for people who want maximum flexibility and nationwide access:

- • No referrals needed for specialists

- • Out-of-network coverage available

- • Nationwide provider networks

- • Higher premiums for increased flexibility

- • Ideal for frequent travelers and self-employed

- • Direct access to any provider you choose

HMO – Health Maintenance Organization

Best for people who prefer lower costs and coordinated care:

- • Lowest monthly premiums available

- • Primary care doctor coordinates all care

- • Referrals required for specialist visits

- • Limited to in-network providers only

- • Predictable copays and costs

- • Strong preventive care emphasis

EPO – Exclusive Provider Organization

Best for budget-conscious consumers who want specialist access:

- • No referrals needed for specialists

- • Lower premiums than PPO plans

- • No out-of-network coverage (except emergencies)

- • Regional or multi-state networks

- • Good compromise between cost and flexibility

- • Streamlined care coordination

POS – Point of Service

Best for those who like coordinated care with some flexibility:

- • Primary care doctor coordination required

- • Some out-of-network coverage available

- • Referrals needed for specialist care

- • Lower costs than PPO for most services

- • More paperwork for out-of-network claims

- • Combines HMO structure with PPO flexibility

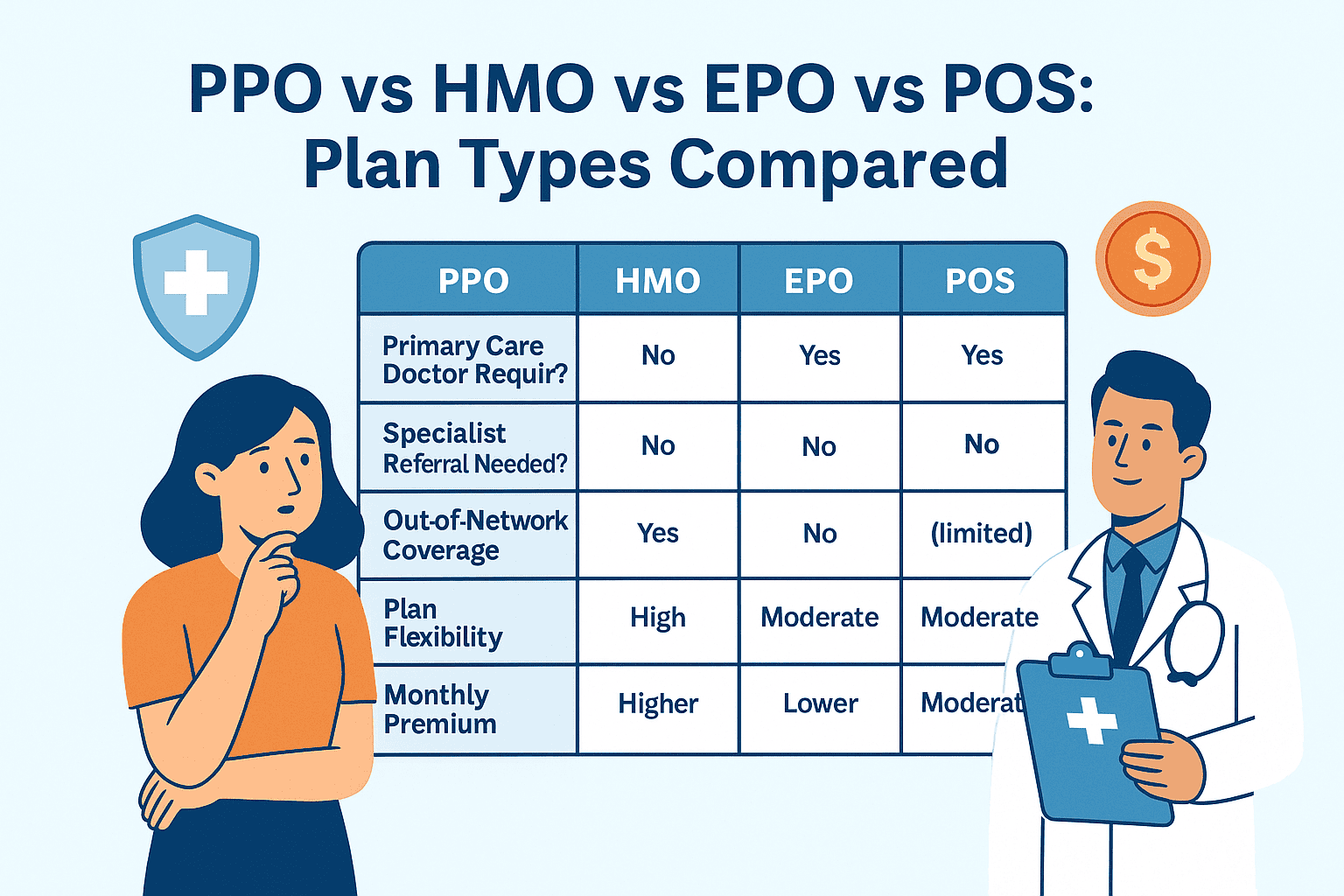

Side-by-Side Plan Comparison

This comprehensive comparison shows how PPO, HMO, EPO, and POS plans differ across key features that impact your healthcare experience and costs.

Health Plan Feature Comparison

| Feature | PPO | HMO | EPO | POS |

|---|---|---|---|---|

| Primary Care Doctor Required? | No | Yes | No | Yes |

| Specialist Referral Needed? | No | Yes | No | Yes |

| Out-of-Network Coverage? | Yes | Emergency Only | Emergency Only | Yes (Higher Cost) |

| Monthly Premium Level | Higher | Lowest | Moderate | Moderate |

| Network Size | Largest | Local/Regional | Regional | Regional |

| Best for Travel/Moving | Excellent | Limited | Moderate | Limited |

| Preventive Care Coverage | Covered | Emphasize | Covered | Covered |

Ready to compare health insurance plans that match your needs and budget? Our licensed specialists can help you evaluate PPO, HMO, EPO, and POS options from top carriers to find the right coverage for your lifestyle. Whether you need maximum flexibility, coordinated care, or budget-friendly options, we’ll guide you through plan features and costs. Call us at 1-888-215-4045 for personalized plan comparisons, or use our tools to explore options and get instant quotes.

Compare Plans NowWhich Plan Type Fits Your Lifestyle?

Understanding how different people use their health insurance helps illustrate when each plan type makes the most sense. Consider these real-world scenarios to identify which approach aligns with your needs.

Sara – Freelance Consultant

Travels frequently for client projects and needs healthcare access in multiple states. Values flexibility over cost savings.

Why PPO: No referrals needed, nationwide coverage, out-of-network options when traveling to rural areas for work.

Daniel – Teacher with Family

Married with two children, predictable income, prefers lowest monthly costs and doesn’t mind coordinated care.

Why HMO: Lowest premiums, predictable copays for family care, strong preventive care for children.

Erica – Part-Time Professional

Works part-time, needs specialist access without referrals, but wants lower premiums than a PPO.

Why EPO: Direct specialist access, lower cost than PPO, good regional network coverage.

Tom – Project Manager

Likes coordinated care but occasionally needs out-of-network specialists for specific conditions.

Why POS: Primary care coordination with some out-of-network flexibility when needed.

Understanding Total Healthcare Costs

While monthly premiums get the most attention, your total healthcare costs include deductibles, copays, coinsurance, and out-of-pocket maximums. Each plan type structures these costs differently to appeal to different usage patterns and risk preferences.

Typical Cost Ranges by Plan Type

- PPO Plans: $450-750/month premium, $1,000-3,000 deductible, highest flexibility

- HMO Plans: $300-500/month premium, $500-1,500 deductible, lowest out-of-pocket costs

- EPO Plans: $350-600/month premium, moderate deductibles, good cost-flexibility balance

- POS Plans: $400-650/month premium, similar to PPO structure with referral requirements

Remember that your total annual costs depend heavily on how much care you use. A higher-premium plan with lower deductibles might cost less overall if you need frequent medical attention, while a lower-premium plan could save money for healthy individuals who rarely need care beyond preventive services.

Why Professional Guidance Matters

While government marketplaces provide basic plan information, working with licensed insurance specialists offers significant advantages in plan selection and ongoing support. Professional brokers understand how plan networks, costs, and features align with different lifestyles and can help you avoid common enrollment mistakes.

Advantages of Professional Assistance

- Same Plans, Same Prices: Access identical coverage at the same cost as direct enrollment

- Personalized Recommendations: Expert analysis of your specific needs and usage patterns

- Ongoing Support: Year-round assistance with claims, network changes, and plan updates

- Multi-Carrier Comparison: Side-by-side analysis of all available options in your area

- Enrollment Simplification: Streamlined application process with expert guidance

Professional brokers can help you evaluate trade-offs between plan types, understand network differences, and select coverage that adapts to changing life circumstances. This guidance becomes particularly valuable when comparing complex features like out-of-network benefits, specialist access, and total cost projections.

Frequently Asked Questions

Which plan type is best for someone who travels often?

PPO plans are usually the best fit for frequent travelers, as they offer the most out-of-network coverage and flexibility across state lines without requiring referrals.

Can I use an EPO plan out of state?

Only for emergencies. EPO plans do not cover non-emergency out-of-network care, even in other states, which limits their usefulness for travelers.

Are referrals always required in HMO and POS plans?

Yes. Both HMO and POS plans generally require you to get a referral from your primary care doctor before seeing a specialist, which can delay access to specialized care.

Which plan type has the lowest out-of-pocket costs?

HMO plans typically have the lowest out-of-pocket costs, with predictable copays and minimal deductibles, but they offer the least flexibility in provider choice.

Can I switch plan types mid-year?

You usually need a qualifying life event—like a job change, marriage, or move—to switch plans outside of the annual open enrollment period.

Do all plan types cover preventive care?

Yes, all ACA-compliant plans must cover preventive care at no cost to you, regardless of whether you choose PPO, HMO, EPO, or POS coverage.

Explore Health Insurance Options

Explore flexible PPO plans with nationwide networks and no referral requirements for maximum healthcare freedom.

Compare top-rated PPO plans with comprehensive coverage, competitive pricing, and extensive provider networks.

Find health insurance solutions designed for freelancers, contractors, and self-employed professionals.

Discover budget-friendly health insurance options that provide essential coverage without breaking the bank.

Access health insurance plans with coast-to-coast provider networks for comprehensive travel coverage.

Explore high-deductible health plans with HSA compatibility for tax-advantaged healthcare savings.

Ready to Choose the Right Health Insurance Plan?

Don’t navigate health insurance plan types alone. Understanding the differences between PPO, HMO, EPO, and POS plans helps you make informed decisions, but our licensed specialists can provide personalized guidance based on your specific needs, budget, and lifestyle. We’ll help you compare all available options, understand network differences, and select coverage that provides the right balance of cost and flexibility. Whether you prioritize maximum freedom, coordinated care, or budget-friendly options, we’ll guide you to the perfect plan. Call 1-888-215-4045 to speak with a health insurance specialist today.

Get Personalized Plan RecommendationsLicensed Specialists • All Plan Types • Personalized Guidance • Free Consultations

Get Your Free Quote

Prefer to speak with an agent?