Best ACA Plans in Texas (2025)

Looking for affordable, comprehensive health insurance in Texas? ACA plans—also known as marketplace or Obamacare plans—offer guaranteed coverage with financial help for millions of Texans. In this guide, we break down the best ACA plans available in 2025, how much they cost, who qualifies for subsidies, and how to choose the right plan for your needs. Whether you’re a freelancer, a young family, or nearing retirement, understanding your options can help you save hundreds per month while staying protected. You may also want to explore private health insurance options in Texas if you’re considering alternatives to ACA plans.

What Is ACA Health Insurance?

ACA plans are health insurance policies offered through the federal marketplace (Healthcare.gov) and designed to meet the requirements of the Affordable Care Act. These plans guarantee coverage regardless of pre-existing conditions and include coverage for hospitalization, prescription drugs, maternity care, mental health services, preventive screenings, and more. These benefits are known as the 10 Essential Health Benefits. Texas uses the federal exchange, which means you apply through Healthcare.gov rather than a state-run platform. Most ACA plans in Texas are HMOs, which limit you to a specific network of doctors and hospitals, but offer lower costs in return.

Who ACA Plans Work Best For in Texas

- Low-income individuals and families: If your income falls between 100%–400% of the federal poverty level, you likely qualify for premium subsidies and possibly cost-sharing reductions that lower your out-of-pocket costs.

- Self-employed Texans or freelancers: With no employer coverage, marketplace plans offer comprehensive benefits and access to subsidies based on your net income.

- Adults nearing retirement age (60–64): ACA plans can bridge the gap before Medicare kicks in at 65. Older adults tend to favor Silver or Gold plans with lower deductibles.

- Families with children: Parents can get marketplace coverage while kids may qualify for CHIP or Medicaid. If you’re covering a spouse or children, review our family health insurance options in Texas for plan comparisons.. Brokers can help you coordinate these mixed household coverages.

- People with pre-existing conditions: ACA plans are guaranteed issue, which means no one can be denied or charged more based on health history.

Best ACA Health Insurance Plans in Texas (2025)

Texas residents have several reputable insurers offering ACA-compliant plans in 2025. These carriers vary in terms of networks, pricing, and digital features:

- Blue Cross Blue Shield of Texas: Offers one of the largest networks in the state, with robust customer service and plan options across all metal tiers. Ideal for those who want broad provider access.

- Ambetter from Superior HealthPlan: Known for competitively priced Bronze and Silver plans. Networks are more limited but suitable for cost-conscious consumers who don’t need specialty care.

- Oscar: A tech-forward insurer with a sleek mobile app, virtual care, and incentives for healthy behavior. Limited availability but popular in urban areas like Austin, Dallas, and Houston.

- Molina Healthcare: Focuses on affordability and accessibility, especially for low-income families. Often includes extra benefits like transportation or over-the-counter stipends.

- Friday Health Plans: Caters to younger, healthier populations. Offers simple, flat-rate pricing and easy digital access. Availability may be limited by region.

| Plan Tier | Monthly Premium* | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Bronze | $360–$420 | $7,500 | $9,450 |

| Silver | $480–$540 | $4,000 | $8,900 |

| Gold | $560–$620 | $1,500 | $6,500 |

*Before subsidies. Actual costs vary based on your age, ZIP code, and income level.

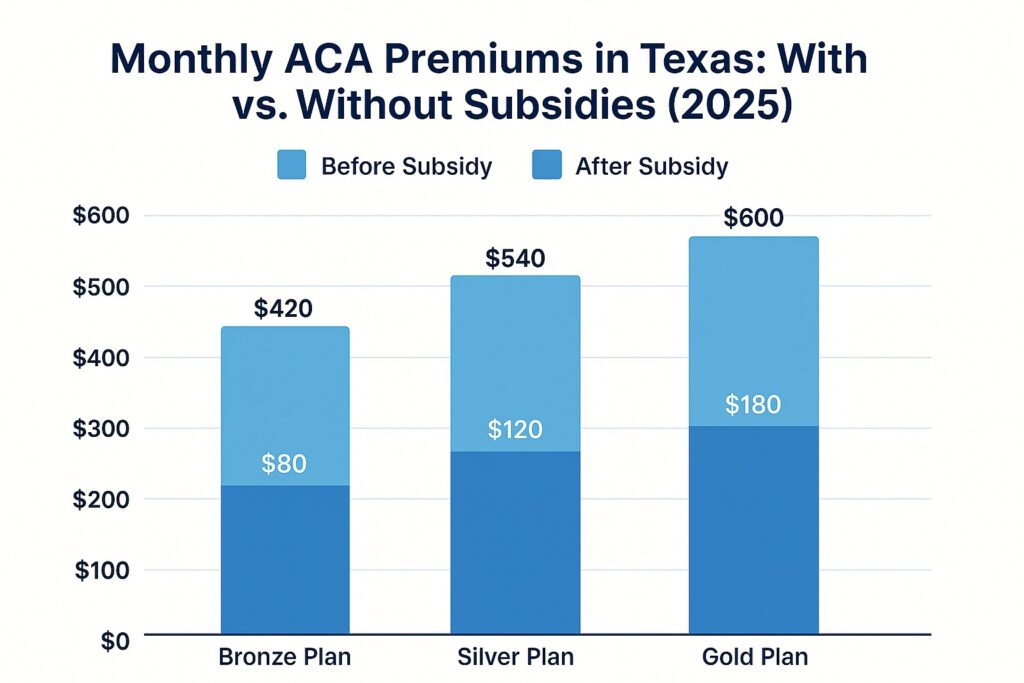

ACA Premiums & Subsidies in Texas

Premium subsidies—called Advanced Premium Tax Credits—are available to Texans who earn up to 400% of the federal poverty level. Cost-sharing reductions (CSRs) are also available for those earning up to 250%, but only when you choose a Silver plan. For example, a 35-year-old in Dallas making $30,000 per year could pay less than $100/month for a Silver plan with reduced deductibles and copays.

The majority of enrollees qualify for some type of subsidy. If you lost Medicaid coverage or changed jobs, you might now qualify for significant ACA savings. Texans looking for short-term options can also review our guide on short-term health insurance in Texas.

When and How to Enroll in ACA Plans

Open Enrollment in Texas runs from November 1 to January 15. This is the primary window when anyone can enroll, switch plans, or renew coverage. If you miss this window, you may still qualify for a Special Enrollment Period (SEP) triggered by life events like marriage, childbirth, moving, or losing other insurance.

What You’ll Need:

- Social Security numbers for all applicants

- Proof of income (recent tax return or pay stubs)

- Immigration documents, if applicable

- Details about any current health coverage

You can apply through a licensed broker for one-on-one help. For a broader overview of options, see our Best Health Insurance in Texas guide.

How to Choose the Right ACA Plan in Texas

Selecting the best plan comes down to understanding your unique needs. Here’s what to evaluate:

- Affordability: Calculate your total annual cost, not just the monthly premium.

- Age & Health Status: Younger, healthy individuals often save with Bronze; frequent care needs point toward Silver or Gold.

- Subsidy Eligibility: Confirm your income level qualifies for subsidies or CSR.

- Network Access: Ensure your doctors, hospitals, and medications are in-network and covered.

- Usage Forecast: If you plan on using the plan regularly, invest in lower out-of-pocket costs.

Tip: Check each insurer’s drug formulary and provider directory before you enroll, or let a broker do it for you.

How a Licensed Broker Can Help With ACA Plans

Licensed brokers offer personalized assistance when shopping for ACA plans, and their help is completely free to you. In fact, they’re compensated by the insurers and receive the same rate regardless of which plan you choose, so there’s no incentive to upsell.

A broker can:

- Check your eligibility for subsidies and CSRs

- Help you compare plan networks, deductibles, and benefits

- Ensure your application is complete and error-free

- Support you during appeals, claims questions, or mid-year changes

For Texans who want expert support without the stress, a broker is your best ally.

ACA Plan FAQs

What’s the difference between Bronze, Silver, and Gold plans?

Bronze plans have lower premiums and higher deductibles. Gold plans are the opposite. Silver plans are mid-tier and may qualify for cost-sharing reductions.

Can I get subsidies if I’m self-employed?

Yes. Self-employed individuals qualify for subsidies based on their net income.

Are dental and vision included?

Not typically. Pediatric dental is included, but adult dental/vision usually requires separate coverage.

Can I change plans mid-year?

Only if you qualify for a Special Enrollment Period due to life changes.

How do I know if my doctor is in-network?

Each plan has a provider directory you can check before enrolling or work with a broker to confirm.

Related Texas Health Insurance Guides

- Best Health Insurance in Texas

- Private Health Insurance in Texas

- Short-Term Health Insurance Texas

- Family Health Insurance Texas

Still Not Sure Which ACA Plan is Right for You?

ACA plans in Texas offer powerful coverage, but comparing options can be overwhelming. Whether you’re just starting out, switching from job-based coverage, or navigating changes in income or health needs, our licensed brokers can walk you through the best path forward.

Don’t risk choosing the wrong plan or leaving subsidies on the table. Reach out today and let a professional help simplify the process so you can enroll with confidence.