Private Health Insurance in Texas

Explore off-exchange plans, PPOs, and private options tailored to Texans who need flexible, year-round coverage.

What Is Private Health Insurance?

Private health insurance refers to any coverage purchased directly from a health insurer or licensed broker, rather than through government programs like Medicaid or Medicare. In Texas, private plans are available both on and off the ACA exchange, with many Texans turning to off-exchange options for greater flexibility and broader networks.

Who Should Consider a Private Plan in Texas?

- High earners: who don’t qualify for ACA subsidies

- Self-employed professionals and freelancers: who need nationwide provider access

- Early retirees: seeking gap coverage before Medicare

- Families and individuals: wanting more provider freedom

Types of Private Health Insurance Plans in Texas

Texans can choose from a range of private plan types, each with distinct features and networks:

- PPO (Preferred Provider Organization): Offers the most flexibility with out-of-network coverage and no referral requirements.

- HMO (Health Maintenance Organization): Lower premiums, but requires staying within a limited network and obtaining referrals.

- EPO (Exclusive Provider Organization): Like an HMO but without referrals. No out-of-network coverage except in emergencies.

- Short-Term Plans: Temporary coverage with limited benefits, useful for gaps in coverage.

- Indemnity Plans: Pay a fixed amount per service but don’t use networks. Not ACA-compliant.

- Catastrophic Plans: High-deductible, low-premium plans available for certain age groups or hardship exemptions.

Off-Exchange vs On-Exchange Plans in Texas

| Feature | Off-Exchange Plans | Marketplace Plans |

|---|---|---|

| Subsidy Eligible | No | Yes |

| PPO Options | More Available | Mostly HMO |

| Enrollment Period | Often Year-Round | Open Enrollment or SEP only |

| Provider Access | Broader (including out-of-state) | Often limited to local networks |

Families vs. Individuals: How Needs Differ

Private insurance in Texas can be tailored based on who you’re buying for. Families typically look for plans that offer pediatric care, family deductibles, and broad provider networks that accommodate multiple needs. Individuals may prioritize mental health coverage, low out-of-pocket costs, or national network access if they travel often.

Private Plan Costs in Texas

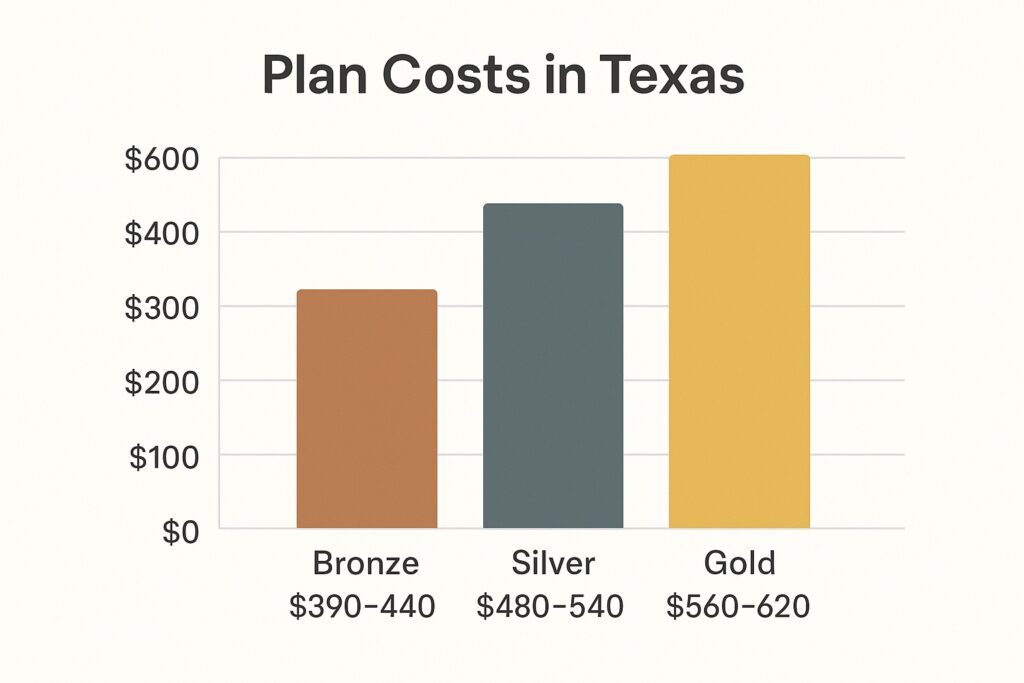

These are sample monthly premiums for a 40-year-old Texan purchasing private coverage without subsidies:

- Bronze: $390–$440

- Silver: $480–$540

- Gold: $560–$620

Premiums vary by region, age, and plan type. PPOs typically cost more than HMOs but offer more flexibility.

How to Choose the Right Private Plan

When comparing private insurance in Texas, consider these key factors:

- Network size: Do you need out-of-state or specialist access?

- Deductible: Can you afford higher out-of-pocket costs for a lower premium?

- Carrier: Look for established companies with strong claims service.

- Broker guidance: A licensed broker can help you evaluate hidden trade-offs and vet the legitimacy of lesser-known plans.

Are PPO Plans Available in Texas?

Yes. Texas has one of the most competitive private PPO markets in the country. While most ACA plans on the exchange are HMOs, many private PPO options are still available off-exchange, particularly for freelancers, 1099 contractors, and small business owners. These plans often include:

- Out-of-network and out-of-state care

- No referrals needed for specialists

- Flexible deductible and copay structures

Learn more about PPO health insurance in Texas.

What to Watch Out For

Not all private health insurance plans are created equal. Be cautious of plans that:

- Aren’t ACA-compliant

- Have limited benefits or confusing exclusions

- Require large upfront fees without detailed coverage documents

Working with a licensed broker helps you avoid common pitfalls and ensures you’re choosing from vetted, legitimate options.

Real Story: Why a Houston Family Went Private

“Our family travels between Texas and California often, and we needed coverage that would work in both places. We found a private PPO plan through a broker that gave us the flexibility we couldn’t get on the marketplace.” — Taylor M., Houston, TX

Real Story: How an Austin Freelancer Found the Right PPO

“I’m a freelance developer and spend months each year traveling. I needed a plan that didn’t tie me to one Texas city or require referrals just to see a specialist. I found a PPO plan off-exchange that covered me wherever I worked—and even let me keep my longtime therapist.” — Jordan K., Austin, TX

How a Licensed Broker Can Help

Sorting through private plans in Texas can feel overwhelming, especially with the rise of limited-benefit or non-compliant plans marketed directly to consumers. A licensed broker acts as a neutral advisor—helping you:

- Compare side-by-side PPO, HMO, and off-exchange plans

- Spot red flags in plans that sound too good to be true

- Access year-round enrollment opportunities

- Get personalized plan recommendations based on your income, provider preferences, and health needs

Our licensed Texas brokers work with major carriers and niche providers to help you find the right fit—at no extra cost to you.

FAQs About Private Health Insurance in Texas

Is private health insurance more expensive in Texas?

It depends. While private plans often have higher premiums, they may offer better value with broader networks and fewer restrictions.

Can I get a PPO plan if I’m self-employed?

Yes. Many private PPO plans in Texas are specifically marketed to self-employed individuals and contractors.

Do I have to wait for Open Enrollment?

Not always. Many private plans are available year-round through brokers or directly from insurers.

Do any private plans include dental or vision in Texas?

Yes. Some private health plans offer optional dental and vision bundles, or allow you to add them separately. A broker can help you identify which options offer the best value based on your needs.

Related Texas Health Insurance Guides

- Texas Health Insurance (Pillar Page)

- Texas PPO Health Insurance

- Private Health Insurance in Texas

- Cheap Texas Health Insurance

- Best Health Insurance in Texas

- Self-Employed Health Insurance Texas

- Short-Term Health Insurance in Texas

- Family Health Insurance Texas

- Health Insurance for Retirees in Texas

- Catastrophic Health Insurance in Texas

Your Texas Private Health Insurance Experts

We help Texans find PPO and off-exchange plans that meet their unique coverage needs. Whether you’re self-employed, retiring early, or just exploring options, our licensed team is here to guide you.