Cheap Health Insurance Illinois 2026

Find the lowest-cost health insurance in Illinois with subsidy optimization, budget-friendly plan options, and professional guidance that maximizes coverage value while minimizing monthly costs.

Finding Cheap Health Insurance in Illinois

Finding cheap health insurance in Illinois for 2026 requires combining subsidy optimization, plan comparison, and cost-reduction strategies. With the state now operating through Get Covered Illinois (a state-based marketplace), you have access to 7 carriers offering budget-friendly options—though that’s down from 11 in 2025.

⚠️ Important 2026 Subsidy Changes

Enhanced subsidies expired December 31, 2025. The “subsidy cliff” has returned at 400% of the Federal Poverty Level. If your income exceeds $62,600 (individual) or $128,600 (family of 4), you won’t qualify for any premium assistance. Accurate income estimation is more important than ever.

The cheapest plan isn’t always the best value—effective cost reduction means analyzing total annual expenses, including deductibles, copays, and out-of-pocket maximums alongside monthly premiums. We help you identify truly affordable coverage that provides real financial protection, not just low premiums with inadequate benefits.

Many residents benefit from exploring affordable Illinois coverage options to understand the full landscape. Understanding Illinois health insurance options ensures you see all available choices before deciding.

Premium Subsidies: Your Key to Lower Costs

Premium tax credits remain the most powerful tool for accessing cheap health insurance. These federal subsidies can reduce monthly premiums by hundreds of dollars for eligible households—but the 2026 rules have changed significantly.

Average savings for subsidy-eligible Illinois families through premium tax credits

2026 Subsidy Eligibility (Updated)

With enhanced subsidies expired, eligibility is now strictly limited to households earning between 100% and 400% of the Federal Poverty Level. Here are the 2025 FPL thresholds that apply to 2026 coverage:

| Household Size | 100% FPL | 250% FPL (CSR) | 400% FPL (Cliff) | Subsidy Eligible? |

|---|---|---|---|---|

| 1 Person | $15,650 | $39,125 | $62,600 | ✓ Below $62,600 |

| 2 People | $21,150 | $52,875 | $84,600 | ✓ Below $84,600 |

| 3 People | $26,650 | $66,625 | $106,600 | ✓ Below $106,600 |

| 4 People | $32,150 | $80,375 | $128,600 | ✓ Below $128,600 |

| Above 400% | Income exceeds 400% FPL | ✗ No Subsidies | ||

Cost-Sharing Reductions (CSR)

If your income falls between 100-250% FPL, you qualify for additional cost-sharing reductions on Silver plans. These lower your deductibles, copays, and out-of-pocket maximums—making Silver plans potentially cheaper than Bronze when you factor in total costs.

Find Out How Much You Can Save

We calculate your exact subsidy amount and compare all low-cost options. Our help is free—you pay the same price as going direct.

Calculate My Savings Call: 888-215-4045Lowest-Cost Plan Options for 2026

You have several low-cost options depending on age, income, and healthcare needs. Understanding each plan type helps you find the cheapest coverage that still provides adequate protection.

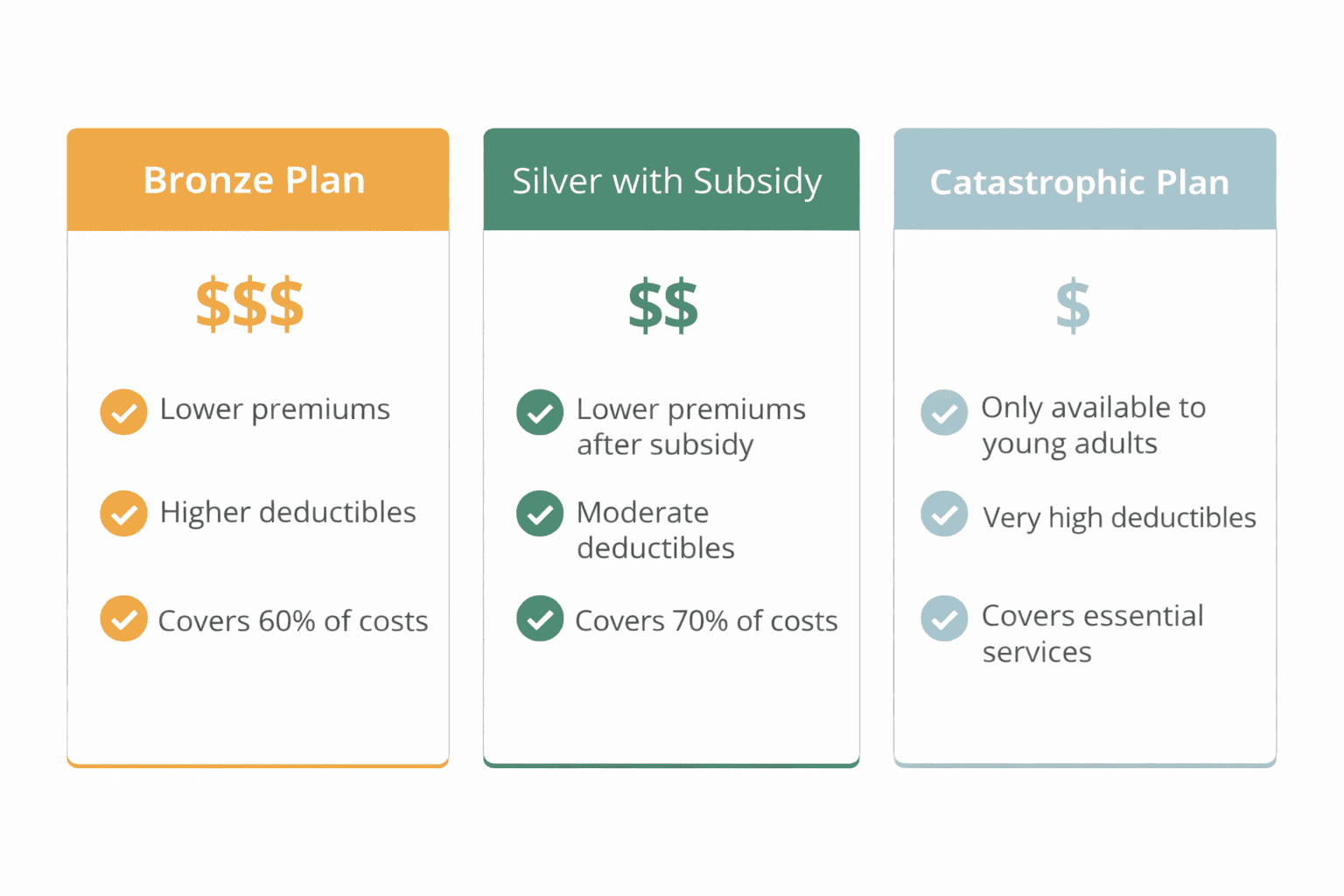

Bronze Plans

Lowest premiums, highest deductibles ($7,000-$9,000). Best for healthy individuals needing catastrophic protection.

Silver + Subsidy

With subsidies and CSR, Silver plans offer excellent coverage at lower total cost. Best for subsidy-eligible households.

Catastrophic

Absolute lowest premiums with $9,450 deductible. Limited to under-30 or hardship exemption. No subsidies apply.

Illinois Plan Cost Comparison

| Plan Type | Monthly Premium | Deductible | Out-of-Pocket Max | Best For |

|---|---|---|---|---|

| Catastrophic | $200-$300 | $9,450 | $9,450 | Under 30, very healthy |

| Bronze | $275-$400 | $7,000-$9,000 | $9,450 | Healthy, budget-focused |

| Silver (No Subsidy) | $400-$550 | $5,000-$6,500 | $9,450 | Moderate healthcare needs |

| Silver (With CSR) | $50-$175 | $1,500-$3,500 | $3,000-$6,500 | 100-250% FPL households |

Budget Carriers for 2026

With only 7 carriers remaining (Aetna, Health Alliance, and Quartz exited), here are the most budget-friendly options:

Ambetter

Consistently competitive premiums statewide with adequate networks. Strong option for cost-conscious shoppers prioritizing low monthly payments.

Molina Healthcare

Budget-friendly premiums with Medicaid-rooted efficiency. Good networks and straightforward plans for residents focused on affordability.

Oscar Health

Moderate pricing with tech-forward approach and strong telemedicine. Available in select counties with competitive rates.

Blue Cross Blue Shield IL

Higher premiums but largest provider network. Worth considering if network access matters more than absolute lowest cost.

Strategies to Reduce Your Costs

Beyond choosing low-premium plans, you can employ multiple strategies to reduce total health insurance costs while maintaining adequate coverage.

Maximize Your Subsidies

Accurate income reporting ensures you get every dollar of premium tax credits available. We verify your subsidy calculation to prevent leaving money on the table.

Consider HDHP + HSA

High-deductible plans offer lowest premiums. Pair with a Health Savings Account for triple tax advantages—works well if you’re healthy with emergency savings.

Accept Network Limits

HMO and EPO plans cost less than PPO plans. If you’re comfortable using in-network providers, you can save significantly on premiums.

Analyze Total Costs

The cheapest premium may cost more overall if deductibles are excessive. We calculate total annual costs based on your expected healthcare usage.

Time Enrollment Right

Open enrollment runs November 1, 2025 through January 15, 2026. Qualifying life events trigger special enrollment periods year-round.

Use Free Preventive Care

All plans cover preventive services at $0 before your deductible. Maximize these benefits to catch issues early and avoid expensive treatments later.

Get a Complete Cost Analysis

We compare all 7 carriers, calculate your subsidies, and analyze total annual costs—not just premiums. Find out your cheapest option that still provides real protection.

Get Cost Analysis Call: 888-215-4045When “Cheap” Becomes Expensive

The lowest premium can sometimes lead to higher total costs through inadequate coverage or excessive cost-sharing. Watch for these red flags when shopping for budget plans:

- Extremely High Deductibles: Deductibles over $9,000 mean you’re essentially paying out-of-pocket for everything except catastrophic care.

- Restricted Networks: Very limited networks may force expensive out-of-network care or prevent access to needed specialists.

- Missing Coverage: Short-term plans and health sharing ministries aren’t ACA-compliant and may exclude pre-existing conditions or essential benefits.

- High Coinsurance: Plans with 40-50% coinsurance after deductible can result in huge bills for hospital stays or procedures.

Many residents exploring top-rated Illinois plans discover that slightly higher premiums often deliver substantially better value. For families, household coverage strategies can optimize costs across all members while maintaining comprehensive protection.

How We Help You Save

We help you find genuinely affordable coverage through services that maximize savings opportunities and prevent costly mistakes—all at no cost to you.

Accurate Calculations

We ensure your subsidy calculation is correct so you get maximum premium tax credits. Small errors can cost hundreds of dollars annually.

All Options Reviewed

We compare all 7 carriers across marketplace and off-marketplace channels to find your absolute lowest-cost options.

Beyond Premiums

We analyze premiums, deductibles, copays, and expected usage to identify plans with lowest total annual cost—not just lowest monthly payment.

No Extra Cost

Our services cost you nothing extra. You pay the exact same price as going direct to the marketplace or carrier.

Official Health Insurance Resources

You can access official government resources for additional information and enrollment assistance.

Get Covered Illinois: The official state marketplace at getcovered.illinois.gov provides enrollment assistance and program information for 2026 coverage.

Federal Resources: Additional marketplace guidance is available through Healthcare.gov for comprehensive enrollment information.

For information about Illinois state programs, including Medicaid and All Kids, we can help determine if you qualify for these no-cost or low-cost alternatives.

Additional Illinois Health Insurance Resources

Comprehensive overview of Illinois health insurance options, carriers, plan types, and enrollment guidance.

Compare Illinois QuotesView personalized health insurance quotes from multiple Illinois carriers with subsidy estimates.

Best Value PlansTop-rated Illinois health insurance plans balancing affordability, coverage depth, and provider access.

Affordable Coverage OptionsLearn how premium tax credits and cost-sharing reductions lower Illinois health insurance costs.

Family Health CoverageIllinois family health insurance options with comprehensive benefits and household-friendly pricing.

Marketplace Enrollment HelpProfessional assistance navigating the Illinois marketplace, deadlines, and plan selection.

Find Your Cheapest Illinois Health Insurance Option

Stop overpaying or risking inadequate coverage. We calculate your subsidies, compare all 7 carriers, and identify the lowest-cost plan that still provides real protection. Call 888-215-4045 to speak with us, or start your comparison online—our help is free.

Find Cheapest Plans Call 888-215-4045Licensed in Illinois • Subsidy experts • Same prices as direct

Independent Broker Notice

ForHealthInsurance.com is an independent health insurance agency serving Illinois residents. We are not affiliated with any carrier or government agency. We help you compare plans and enroll in coverage that meets your needs at no extra cost to you.