Best PPO Health Insurance Plans for Freelancers & 1099 Contractors

Enjoy nationwide coverage and provider flexibility with top-rated PPO plans tailored for independent professionals and gig workers. Whether you’re self-employed, working part-time, or earning freelance income from multiple clients, a PPO plan can provide the freedom and reliability you need.

Why PPO Plans Work Best for Freelancers

As a freelancer or 1099 contractor, your work and travel needs don’t fit the mold of traditional employment. You may be working from a co-working space today and traveling to another state tomorrow. PPO plans offer:

- Freedom to see any doctor without referrals

- National coverage — great for digital nomads

- Out-of-network coverage if you travel often

- Ideal for those with unpredictable schedules or moving between states

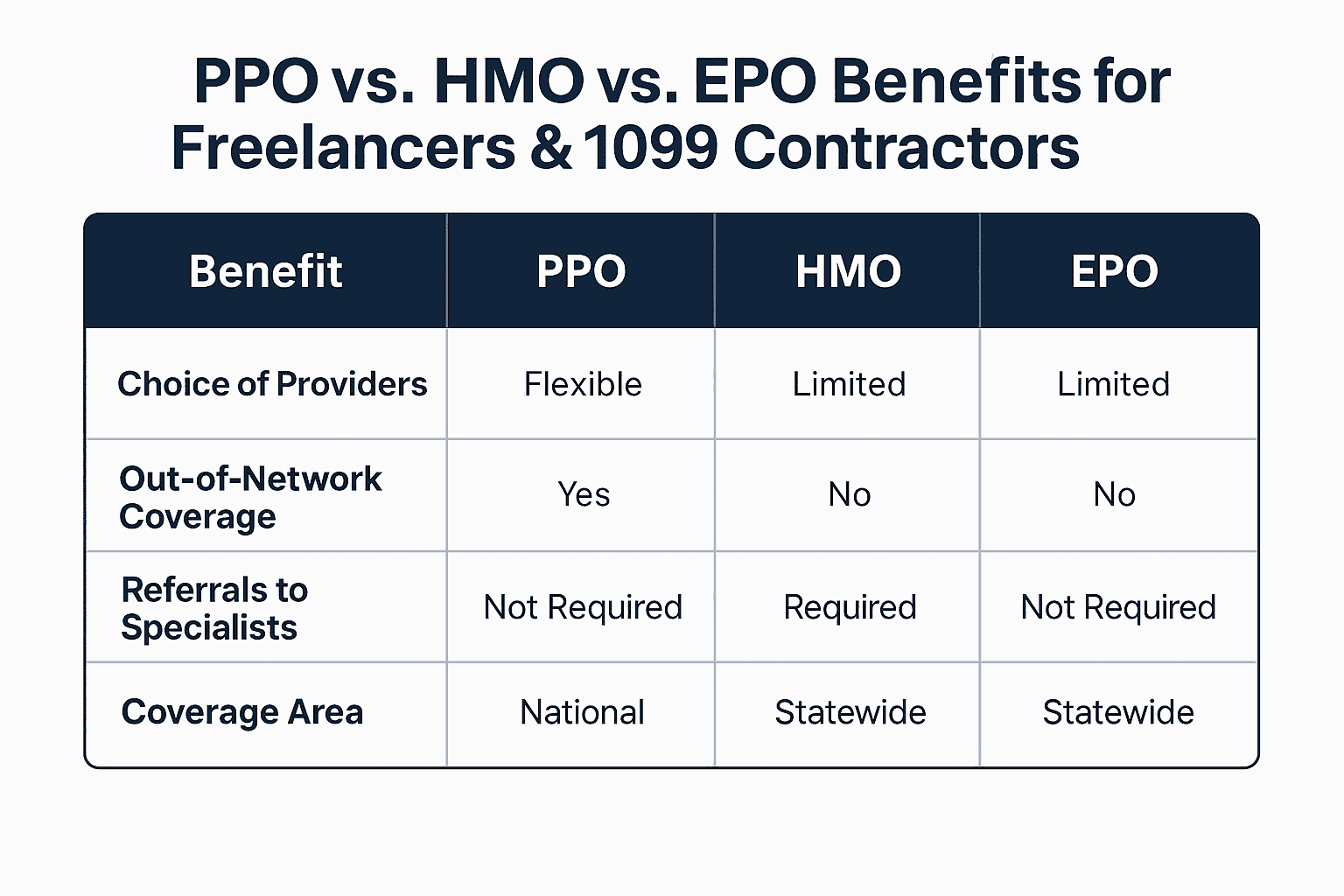

Unlike HMO or EPO plans, PPOs let you manage your healthcare without needing pre-approvals for most visits. Learn more about PPOs.

What to Look for in a Freelancer PPO Plan

Choosing the right PPO plan depends on how and where you work. Ask yourself:

- Do you travel often? A national PPO ensures you’re covered wherever you go.

- Do you want to contribute to a Health Savings Account (HSA)? Look for a high-deductible PPO that’s HSA eligible.

- Are you managing chronic conditions? Pick a plan with strong specialist coverage and prescription benefits.

- Need virtual access? Some PPOs include unlimited telehealth visits — a great fit for busy freelancers.

Don’t forget to consider the out-of-pocket maximum, network size, and any perks like wellness benefits or mental health services.

Plan A – Nationwide PPO

This robust plan is ideal for contractors who frequently cross state lines. With a wide network of doctors and hospitals across the country, you can get care wherever you go without sacrificing coverage.

Monthly Premium: ~$520

Deductible: $2,500

Out-of-Network Coverage: Yes

Plan B – High Deductible PPO (HSA Eligible)

This plan is a great match for freelancers who want to lower monthly costs and save for medical expenses tax-free. You can pair it with an HSA to save strategically.

Monthly Premium: ~$420

Deductible: $4,000

OON Coverage: Yes

HSA Compatible: Yes

Plan C – PPO with Enhanced Telehealth

Perfect for remote professionals, this plan includes unlimited virtual visits with primary care and mental health providers. It’s designed to save you time and keep you productive.

Monthly Premium: ~$480

Deductible: $3,000

Out-of-Network: Yes

Telehealth: Unlimited virtual visits

How to Choose a PPO Plan Based on Your Work Style

No two freelancers work alike. The ideal PPO plan for a traveling consultant might not fit a stay-at-home content writer. Here’s how your work style can shape your decision:

- Digital Nomads: Look for plans with national networks and strong OON coverage.

- Part-Time Side Hustlers: Choose a plan with low premiums and decent preventive care benefits.

- Full-Time Freelancers: Consider comprehensive PPOs that include wellness, dental, and Rx coverage.

- Remote Teams or Multi-Contract Workers: PPOs with flexible provider networks make it easy to adapt.

Many freelancers operate as sole proprietors or 1099 contractors. If you’re looking for PPO plans tailored to your business setup, explore our guide to PPO plans for the self-employed.

Real-World Examples

- Freelancer in Austin, TX: A web developer who works remotely and travels for conferences chooses a national PPO for provider access in multiple states.

- Contractor in rural Montana: Needs access to specialists in larger cities and prefers flexibility with in- and out-of-network doctors.

- Digital nomad: Works from different states every few months, requiring a PPO with broad provider access and portable benefits.

Tax Benefits of PPO Plans for Freelancers

Health insurance is not just a necessity; it can also be a strategic business expense for independent contractors. If you file taxes as a self-employed individual, you may be eligible to deduct your monthly health insurance premiums under IRS guidelines.

Additionally, if you enroll in a high-deductible PPO plan that is HSA-compatible, you can contribute to a Health Savings Account (HSA). HSAs offer triple tax benefits:

- Contributions are tax-deductible

- Funds grow tax-free

- Withdrawals for qualified medical expenses are tax-free

Consult a licensed tax advisor or accountant to learn how your health plan can work to your advantage during tax season.

Frequently Asked Questions

Do PPO plans cover out-of-network providers?

Yes, PPO plans typically reimburse a portion of the cost for out-of-network services, though at a lower rate than in-network care.

Are PPO plans more expensive?

They generally have higher premiums than HMOs but offer more flexibility and fewer restrictions.

Can I use a PPO plan in different states?

Yes, many PPOs have nationwide networks or allow out-of-network reimbursement across states, making them ideal for freelancers who travel.

Can I switch PPO plans mid-year if my income changes?

In most cases, you can only switch plans during the annual Open Enrollment Period unless you qualify for a Special Enrollment Period (SEP). A significant change in income may trigger an SEP if you’re buying through a marketplace.

How do I find out if my provider is in-network?

Each insurer offers a provider search tool online. You can also call the carrier directly or ask your broker to verify in-network status before you enroll.

What documents do I need to enroll as a freelancer?

You may need to provide proof of income (e.g., 1099 forms, invoices, bank statements) depending on the enrollment platform and whether you qualify for subsidies.

Need Help Choosing a PPO Plan?

Let our licensed agents guide you to the best coverage based on your work style, travel needs, and budget. We specialize in helping freelancers and 1099 workers find flexible plans that work nationwide.

Call now to speak with an expert, or click below to begin comparing plans tailored to your ZIP code.